Benefits

Leverage the Leading AI-Enabled Solution to Simplify Fund Management

Embrace Innovation

Leverage AI to automate strategic tasks in the fund lifecycle and don’t get left behind.

Proactively Manage Risk

Demonstrate your ability to reduce errors and get audit ready in the face of increasing regulatory scrutiny.

Reduce Expenses

Use innovative technology to keep legal expenses low when fundraising and meeting contractual obligations.

Increase Transparency

Gain real-time visibility into MFN elections and compliance by digitizing investor and legal workflows.

Features

Confidently Fundraise and Deliver on Obligations with the Power of AI

Insight allows you to expedite your fundraise, run a modern MFN election process, and demonstrate side letter compliance.

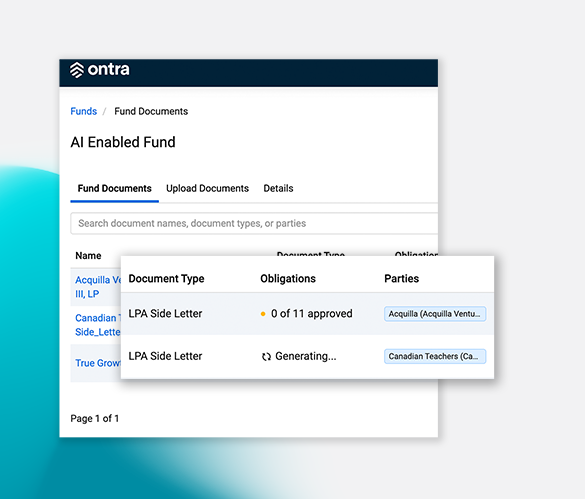

AI-Enabled Contract Digitization

Leverage Ontra’s abstraction capabilities, now also built on Open AI’s GPT-4, to quickly identify and categorize clauses from fund documents.

Transform contracts into structured data by identifying legal clauses and highlighting corresponding document language in seconds. Watch Now

Match and group new clauses automatically with similar obligations from existing fund documents using Ontra’s proprietary search algorithm.

Generate obligation names, descriptions, and categories written by AI models and approved with human-in-the-loop oversight.

Searchable, Digital Compendia

Generate a digital and easily searchable repository of agreements and obligations.

Purpose-built to store and manage critical fund information and documents such as LPAs, Side Letters, MFN Election Forms, and Subscriptions in a single, secure location.

Quickly find contract language and summary descriptions using SmartSearch, Insight's search algorithm powered by industry-leading AI models.

Use SmartLine to identify similarities and differences among an unlimited number of provisions.

Reference precedent to negotiate better outcomes for your firm.

Want to learn more? Request a demo today.

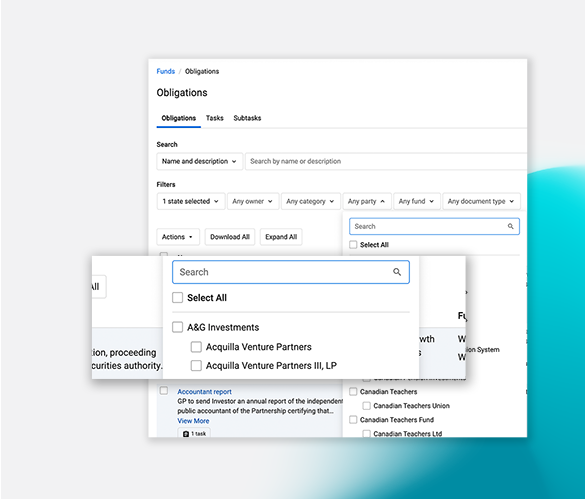

Obligation Compliance

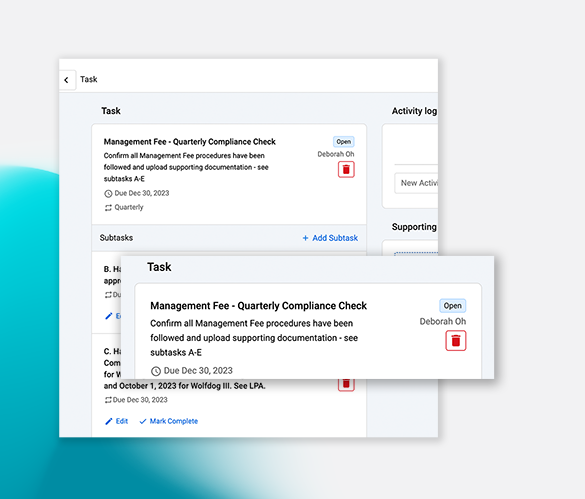

Assign, monitor, and report on obligation compliance efforts.

Build multi-stakeholder task workflows to support compliance with critical event-based and recurring obligations.

Create quarterly compliance checks, align on internal review and sign-off processes, and mark tasks complete to create an activity log in preparation for exams.

Export fund documents and data necessary to demonstrate side letter compliance in seconds.

Digital MFN Elections & Disclosures

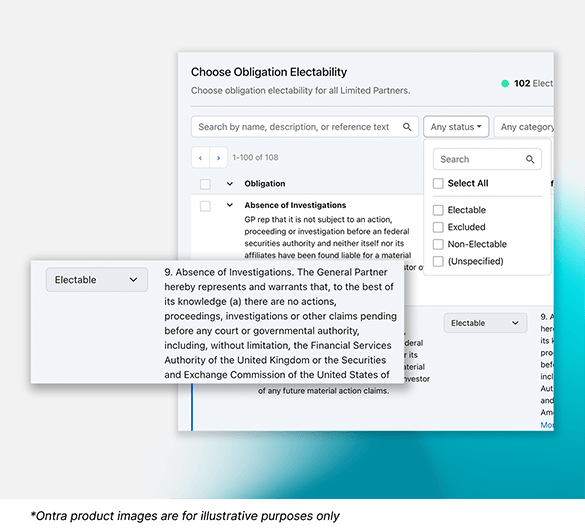

Run a modern MFN election and disclosure process and manage all resulting obligations. Learn More

Convert side letters to digital agreements and contract obligations as soon as available.

Create forms using commitment thresholds and investor characteristics to determine the display of electable provisions and disclosures.

Distribute forms, track progress, and review investors’ elections in a single digital platform.

Seamlessly reflect elections in Insight to manage obligations over the fund life.

Navigate preferential treatment rules by creating disclosure schedules for prospective investors, redacting confidential information, and distributing reports.

How Insight Works

Digitize

Leverage industry-leading AI models to identify and categorize clauses from fund documents in seconds.

Fundraise

Simplify and expedite MFN elections and disclosures.

Search & Comply

Easily search, assign, and report on obligation compliance efforts.

Examples of Documents Serviced

Side Letters

MFN Election Forms

Limited Partnership Agreements

Testimonials

Don’t Get Left Behind

Industry leaders use Insight to reduce costs and mitigate risks by digitally transforming the most tedious aspects of fund operations.

“In the three years we’ve partnered with Ontra, their Insight solution has helped ensure we’re in compliance with all of our contract obligations. We’re incredibly pleased with Ontra’s use of cutting-edge technology to deliver legal solutions optimized for quality, speed, and low cost. Adding AI into the mix with Ontra Synapse is another win for a company with a long track record of innovation.”

Neal Kalechofsky

Vice President, Alternatives Legal, AllianceBernstein

Vice President, Alternatives Legal, AllianceBernstein