Traditional methods of managing NDAs, also known as confidentiality agreements, simply don’t cut it for fast-paced fund managers anymore.

Manual review by your internal legal teams is time-consuming and takes you and your colleagues away from higher-value work. Outsourcing to external counsel isn’t always an option. It’s often a slow and expensive process in the long run, and the junior associates or non-legal team members handling NDA negotiations might agree to off-market and inconsistent terms.

AI-powered NDA management software from Ontra offers an efficient and cost-effective alternative to traditional NDA outsourcing and manual in-sourcing options. Here’s how you can improve efficiency, reduce costs, and relieve employee bandwidth with Ontra.

M&A optimism and competition could boost NDA volume

The M&A market improved slightly in 2024, with U.S. and global total deal counts remaining flat but with total deal values increasing 13% and 15%, respectively, compared to 2023. While geopolitical tensions and regulatory uncertainty still make fund managers a bit wary, they’re overall optimistic about fundraising and dealmaking in 2025.

The SRS Acquiom Barometer™: 2025 M&A Outlook survey found that in December 2024, nearly half of respondents were experiencing more deal volume relative to a year ago. Fifty-one percent were pursuing exit and acquisition opportunities, and 93% believed M&A volume would be moderately or dramatically higher in 2025.

Dry powder levels are higher than ever, and the 2025 M&A Outlook survey respondents noted that dry powder and pent-up demand would be the biggest factors in driving 2025 deal volume. Overall, private fund managers will be competing for deals. This fierce competition forces fund managers to review a greater number of target companies for every deal they complete. That means more NDAs.

The negative impact of high-volume NDAs

Rising NDA volumes are a heavy burden for all fund managers:

- Smaller or emerging private fund managers might lack an internal legal team. They often rely on business professionals to review NDAs in-house or expensive outside counsel.

- Mid-size private fund managers may have a lean in-house legal team that can’t keep up with the number of NDAs they need to process every week or month. These firms might also need to lean on non-legal professionals during negotiations or send agreements to their outside counsel.

- Large fund and asset managers are forced to dedicate significant in-house legal resources to NDA negotiations or pay excessive outside counsel fees.

No matter the firm’s size or AUM, it will need significant internal resources or an external provider to efficiently and consistently turn around a high volume of NDAs.

Manual NDA management can slow down the deal process

Manual NDA negotiations are labor-intensive, requiring significant time and resources no matter who handles the process.

Each potential deal demands legal or non-legal professionals spend hours turning around markups on these repetitive contracts. Fund managers relying on investment professionals to negotiate terms may take longer to turn around and execute an agreement. When outsourced to external counsel, NDAs typically go to junior associates, yet are billed at a standard rate, accruing costs quickly.

Whether a fund manager handles NDAs internally or externally, manual NDA negotiations tend to drag on, preventing the firm from accessing data rooms, beginning diligence sooner, and gaining a competitive edge in the deal process.

Manual NDA management can introduce room for errors

Inconsistent terms

Inconsistent NDA terms can lead to complex compliance efforts. If a firm’s NDAs create a jigsaw of obligations, the legal and compliance teams will likely have a harder time keeping track of requirements and complying with and enforcing each agreement. More consistent terms across your NDA can be an advantage in helping your firm negotiate from a position of strength, monitor contract compliance, and prevent confusion or disputes.

Off-market provisions

Contract terms that deviate from market norms can lengthen NDA negotiations when the other party’s expectations are based on standard industry practices. In the worst-case scenario, negotiations break down, prematurely ending the deal process.

Even if a firm has established guidelines or playbooks, in-house professionals might struggle to stick to predefined contract terms across manual NDA negotiations. This is common for firms that lack centralized storage and accessible, structured contract data. Visibility challenges can lead to unnecessary problems and delay contract turnaround times.

Lack of transparency

When a fund manager is navigating a high volume of NDAs, they often assign multiple in-house professionals to negotiate these agreements. Large fund managers might rely on multiple external law firms. In both cases, it can be difficult for all stakeholders to know exactly where a negotiation stands. Email threads get separated or individuals omitted from chains, leading to even more back-and-forth emails. Once parties complete their negotiations, the terms may impact more than the direct deal team, yet affected departments may not be clued into agreement obligations, risking a costly misstep.

5 benefits of AI-powered NDA management

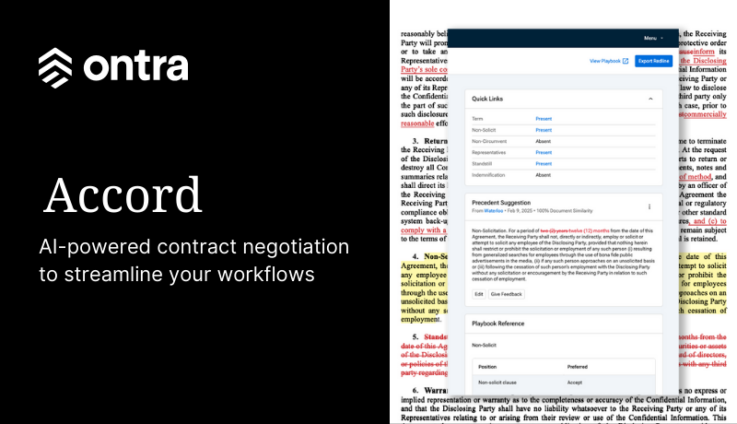

Ontra’s NDA negotiation technology combines AI efficiency with industry expertise to provide fund managers with a modern, streamlined solution that redefines traditional NDA management.

Here are some key benefits of managing NDAs with an AI-powered legal tech solution:

Speed: Customers can incorporate AI-enabled data insights and workflow tools to negotiate from a position of strength and move contracts forward faster. Ontra’s Markup Builder feature surfaces language from a firm’s previous, similar documents and negotiation playbook guidelines. This type of automation allows the firm’s stakeholders to negotiate and execute repetitive contracts faster than is possible with traditional methods. Faster NDA turnaround times mean that firms can begin due diligence sooner, streamline decision-making, and close on high-caliber deals faster.

Consistency: By implementing a digital playbook, customers can improve the consistency of their NDA terms no matter who handles negotiations. Ontra’s Digital Playbooks enable customers to customize their negotiation preferences within the app to create a dynamic, single source of truth. Playbooks sync negotiation preferences across teams by digitally documenting preferred, fallback, and final positions.

Visibility: Ontra’s contract automation platform offers a secure, centralized platform for all stakeholders to collaborate on contract negotiations. Those with access to the app can see the status of each contract at any time.

Data-driven insights: Customers can access an AI-powered summary of key legal and business terms for each agreement shortly after they complete negotiations. Additionally, AI captures and categorizes contract data to provide dynamic reports in Ontra’s app. Contract dashboards and reports allow fund managers to access structured contract data without manually managing databases or sifting through prior contracts.

Cost savings: Firms that use AI-powered tools to augment and streamline their NDA negotiations benefit from lower and more predictable fees compared to manual AI management or outsourcing to a traditional law firm.

Ready to better manage NDAs?

Gone are the days when private fund managers could rely on manual processes and in-house resources to manage NDAs effectively. Now, firms that don’t have the right technology and workflows can experience process inefficiencies, high costs, and subpar outcomes.

Ontra offers cutting-edge AI solutions designed to optimize legal and compliance workflows for the private markets. Our contract automation solutions combine AI NDA management software, comprehensive digital playbooks, and deep industry expertise to efficiently support consistent, high-quality NDAs.

Request a demo to learn more about our contract automation solutions today.