As investor side letters increase in frequency and complexity, managing Most Favored Nations (MFN) elections is becoming exponentially more expensive and time-consuming for private fund managers. Traditional processes — like relying on outside counsel to manually create forms, collect and review elections, and assemble lengthy compendia — leave fund managers with limited visibility into a process that often exceeds their organization’s expense caps.

Fund managers need an easier way to process MFN elections to ensure they can understand and comply with the full scope of their obligations.

Insight from Ontra provides a better alternative to traditional MFN elections with an end-to-end AI-powered solution for private equity firms and their counsel to digitally generate and distribute MFN election forms and automatically update a digital compendium as a single source of truth for investor obligations.

Digital MFN elections streamline form creation, distribution, and ongoing obligation compliance so firms can run efficient MFN processes, manage all resulting obligations in a single platform, and reduce fund expenses and the risk of election errors.

With the addition of dMFN, Insight now allows users to:

- Generate MFN election forms using commitment thresholds and investor characteristics to determine the display of electable provisions and disclosures

- Distribute MFN election forms via Insight or export a PDF version to deliver via another method

- Review and accept investors’ elections in a single platform

- Reflect elections in the Insight platform to manage obligations over the fund life

Let’s take a closer look at how GPs can run a digital MFN election after onboarding their side letters into Insight.

How to generate MFN election forms in Insight

GPs or their counsel can start a new MFN project and generate forms in minutes with insight.

To begin a new MFN election project:

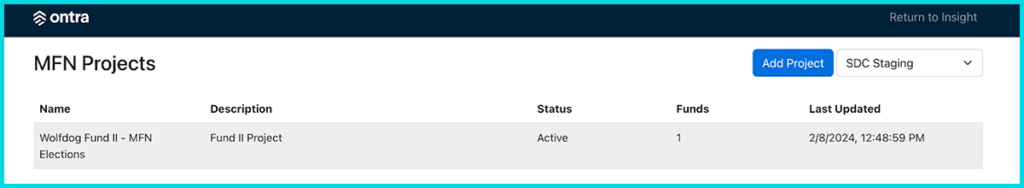

- On the Funds Overview page, select View MFN Projects, then select Add Project.

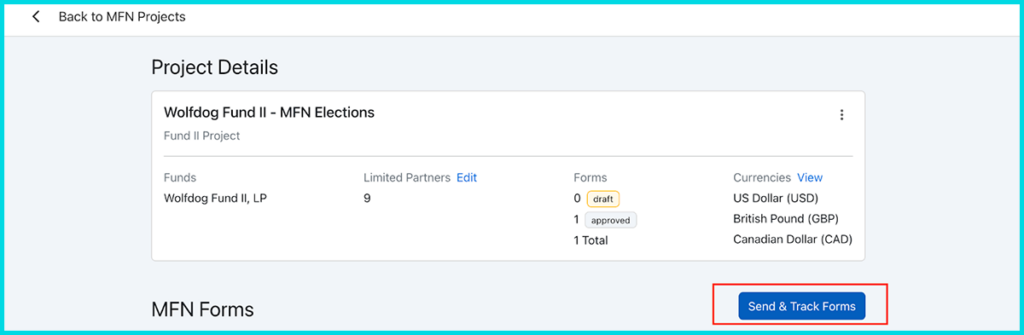

- Add details of the MFN project: Select the relevant fund, add a description, and then click save.

- Select the investors eligible to receive an MFN election form.

- If needed, click on any LP to review the MFN clause in their side letter.

- Add currency conversion rates to compare details across forms properly.

To generate specific MFN election forms:

- Name the form, click save, then select the LPs to create forms for.

- If desired, add a cover letter.

- Using filters, select obligations and assign each a status: electable, non-electable, or excluded from the form.

Insight allows GPs and their counsel to redact sensitive information from the MFN forms. Simply highlight the text, then click the small plus sign icon to redact the selected text, and investors will not see this text on their forms.

How to distribute MFN election forms via Insight

Insight offers an end-to-end MFN election solution by ensuring GPs and their counsel can deliver MFN forms through the platform. On the MFN Projects page, GPs may have multiple ongoing MFN election projects and forms. Insight makes it simple to navigate these various elections.

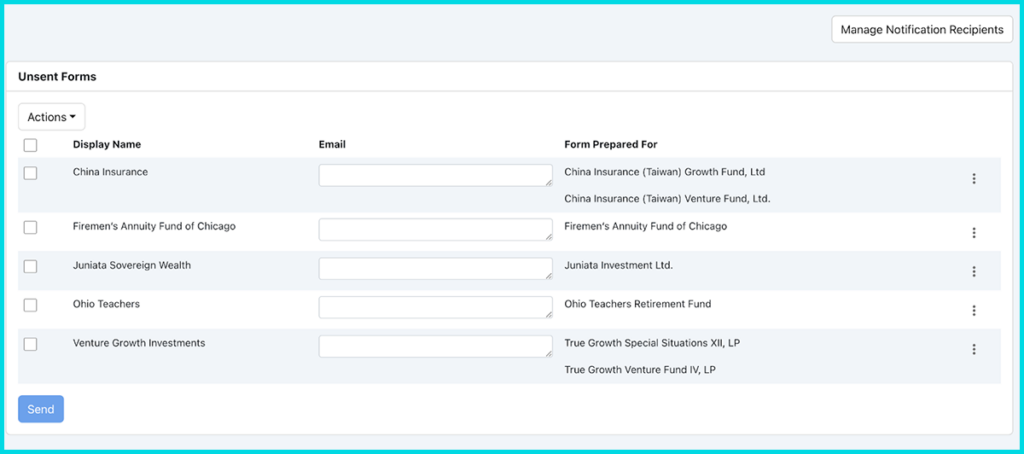

To distribute MFN election forms to LPs:

- On the MFN Projects page, select the relevant form, then click Send & Track Forms.

- Enter an email for each investor.

- De-select recipients from this list in order to send a PDF election form via email or another method.

The investor MFN experience

With Insight’s digital MFN election process, investors have a simple way to designate new obligations.

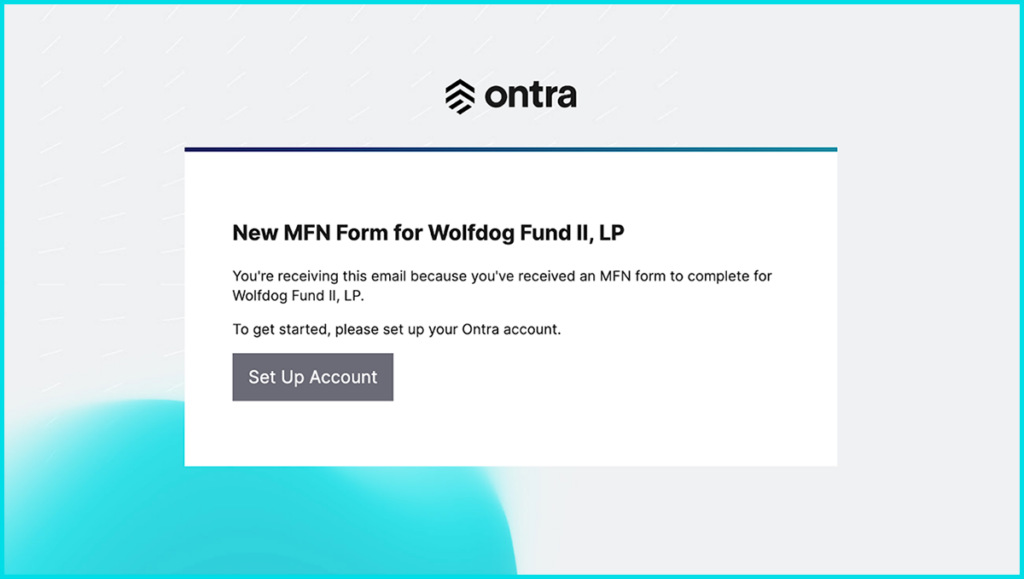

When GPs distribute MFN election forms through Insight:

- Each investor receives an email notifying them of the MFN election

- First-time LPs must set up an account in Insight; however, returning LPs only need to sign in with their password

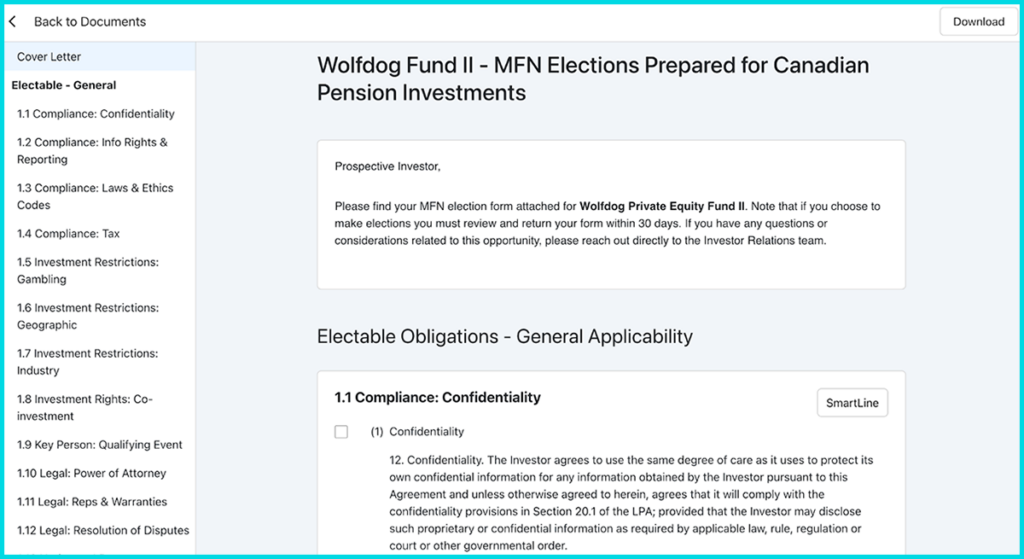

- Investors see the form and a table of contents on the left

MFN forms are often difficult for investors to navigate and understand during a traditional MFN election process. As a result, GPs and their counsel often deal with inaccurate choices from their investors, and then spend weeks or months communicating with LPs to confirm their wishes.

In Insight, investors can use the SmartLine feature to compare the clauses they could elect. This prevents LPs from selecting repetitive clauses and forcing counsel to work closely with LPs to correct their elections.

Insight automates new investor obligation updates

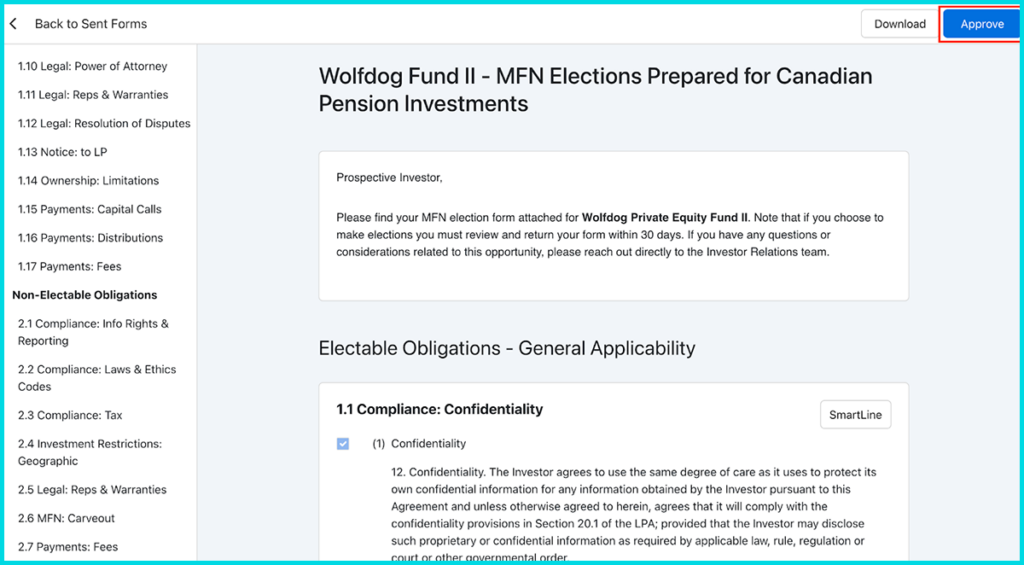

Insight is an end-to-end solution that enables GPs to quickly access their new investor obligations after an MFN election. GPs and their counsel can review elections, and once they accept the LP’s choices, the updated investor obligations are reflected back in Insight immediately.

After LPs make their choices, the designated party for the GP will receive a notification email through which they can:

- Select to review an LP’s elections from the notification email.

- Read through the elections and download a copy of the form.

- Click approve to update elections in Insight automatically.

Expedite the MFN election process with Insight

Insight from Ontra is the leading AI-enabled solution that simplifies fund management. By embracing this cutting-edge legal technology solution, you can simplify fund management, proactively manage risk, increase transparency, and reduce expenses.

Leading private fund managers are already using Insight to supercharge their fund operations, from running digital MFN elections to responding to SEC exams. If you’re ready to see what Insight can do for you, sign up for an Insight demo today.