Recent industry trends, advances in large language models (LLMs), and the need to remain competitive are driving the adoption of AI-powered legal automation at private markets firms of all sizes.

Our recent guide, Private Fund Managers’ Guide to Legal Automation, discusses the factors influencing the shift away from outsourcing and the benefits of AI legal tech. We also include the initial steps you need to get started.

The following is a quick overview of the guide.

What is legal automation?

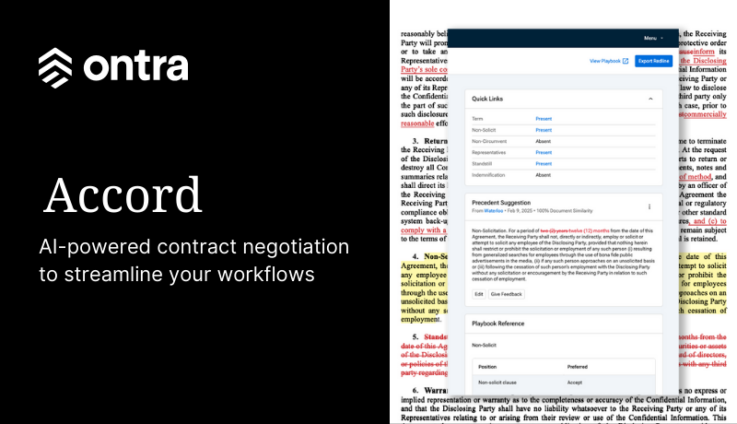

Legal automation uses technology to streamline and optimize critical legal and compliance workflows across the fund lifecycle. Examples include digitizing contracts, automating contract negotiations, classifying fund obligations, running MFN elections, managing entities, generating reports, and more.

How did private markets firms handle contract negotiations and management before AI legal tech?

Before now, private markets firms have had limited choices for handling repetitive, manual legal and compliance tasks.

When the negotiation and management of NDAs and other legal agreements are kept in-house, lean legal teams become mired in manual tasks, slowing the firm’s ability to close deals and grow. Alternatively, firms often rely on legal process outsourcing (LPO) to manage workflows that exceed internal capacity. However, this strategy has become too cost-prohibitive and inefficient.

Industry trends driving legal AI tech adoption

Faced with the challenges of legal process outsourcing, growing private markets firms are rapidly adopting a more automated approach. Several factors are driving the private markets industry toward greater automation, including globalization, firm growth, significant data volumes, a complex regulatory environment, and rising legal expenses.

8 key trends influencing AI adoption in private markets:

- Availability of AI tools

- Rising fundraising and deal competition

- Regulatory complexity

- Budgetary demands

- Automation of repetitive tasks

- Democratization of private markets

- Increasing expectations on legal teams

- Human-in-the-loop AI systems

The shift toward AI legal tech and automation is driving efficiency and value for firms without increasing their headcount or external legal expenses.

Don't miss Ontra's expert insights

Join our newsletter to stay up to date on features and releases

By subscribing you agree to our Privacy Policy

Thanks!

The competitive advantage of legal automation

Private fund managers now realize that implementing an AI-powered legal automation solution reduces costs and improves their competitive edge. When investment, legal, and compliance teams are freed from the time-consuming, manual tasks inherent in contract negotiation, obligation management, and entity management, they have time to focus on higher-value work, make better decisions, and close deals faster than the competition.

Notably, the private fund managers we work with have said that they have gained peace of mind — a better night’s sleep — using Ontra’s Insight and Atlas solutions to handle obligation and entity management, respectively, and Contract Automation to quickly process contracts that adhere to a standardized playbook.

10 benefits of adopting legal workflow automation powered by AI:

- Integrating data sources and analytics

- Creating a single source of truth

- Leveraging data-driven insights

- Gaining a competitive edge

- Improving contract analysis and negotiation

- Digitizing entity management

- Maintaining human expertise

- Lowering operational costs

- Optimizing resource allocation

- Scaling efficiently

Your step-by-step guide to reimagining legal workflows

Our guide to legal automation for private markets firms outlines the initial steps necessary to drive operational efficiency with legal automation. The journey begins by finding the right AI legal tools for your unique needs.

The 6 steps to help you get the most value from your AI legal tech investment:

- Identify your unique areas of need

- Look for tools to match your challenges

- Prioritize security and reliability

- Buy for the future

- Leverage onboarding and training

- Start small and scale

By embracing AI-powered legal automation, private markets firms can reduce costs, improve overall performance, and gain a competitive edge. Legal automation frees legal, compliance, and deal teams to perform higher-value work, deliver better investor experiences, and close deals faster.

Take a deeper dive into the influences and benefits of legal automation with our guide, Private Fund Managers’ Guide to Legal Automation. Understand the trends and learn how a digital transformation can help you improve efficiency and gain a competitive advantage.