By Frank Giovinazzo, VP/GM of Contract Automation

As spring training approaches, let’s revisit a classic story from Major League Baseball: Moneyball. Ontra first explored the parallels between the role of data analytics in baseball vs. its role in the private funds and legal industries in our 2020 webinar, Moneyball for Dealmaking: Data Analytics for Your Contracts.

As digital transformation accelerates at a breakneck pace, we felt the time was right to reexamine the lessons of Moneyball and consider how generative AI (GenAI) — like data analytics before it — is now driving a step-level change in the legal industry.

Just as baseball executives grew to embrace analytics, deal professionals are beginning to use complex analytics to help drive better investment decisions. The forward-thinking legal professionals that support them are, in turn, using new legal technology and analytics to transform the way they work and deliver results for clients. For high-volume, routine contracts, like non-disclosure agreements (NDAs), GenAI is proving to be a game changer.

Applying the lessons of Moneyball to contracting

For anyone unfamiliar with Moneyball: The Art of Winning an Unfair Game, author Michael Lewis explains how the Oakland Athletics and their general manager, Billy Beane, used data analytics to gain a competitive advantage in baseball. As a small-market team, the Oakland A’s found it hard to compete with top-performing teams that had more money for recruiting and retaining players.

The A’s reevaluated their scouting strategy and used sabermetrics — the empirical analysis of baseball — to identify and recruit undervalued players. Being on the cutting edge of applied mathematics enabled the A’s to win 103 games in the 2002 “Moneyball” season and consistently compete with top market teams for years to come. Their successful application of sabermetrics transformed the sport.

The forward-thinking application of a new science is playing out in the legal industry right now.

As a leader in contract automation and intelligence since 2014, Ontra has been at the forefront of applying technology to streamline legal processes for the past decade — processing over one million contracts for private investment and financial services firms along the way.

We’ve employed a dedicated approach to data extraction and analysis to drive significantly more value for our customers in the form of less expensive, faster, and more consistent contract negotiations. The emergence of commercial large language models (LLMs) and the advancement of GenAI over the past year build upon this foundation and greatly enhance the opportunity for dealmaking and legal professionals to drive efficiencies in their routine legal workflows.

For investment professionals seeking to replicate the Oakland A’s success in gaining a competitive advantage, now is the time to embrace GenAI.

The AI advantage in contract negotiations

As sophisticated as private fund managers are, many still rely on contract workflows that have not changed for the past 10 to 20 years. It’s reminiscent of the old-school baseball scouts who initially shied away from sabermetrics, instead relying heavily on their personal experience and insight to grade players.

Old-school contract review typically involves a single lawyer or deal professional marking up a contract to conform it to the firm’s standards. This approach relies on the legal or deal professional’s experience and pattern recognition and rarely integrates broader or updated market information. Negotiating contracts is done manually, necessitating a comprehensive review of each individual document as a matter of first impression, often requiring the professional to make the same in-line revisions to agreements over and over again.

Think of how much consideration, judgment and, well… typing… goes into negotiating a contract, even one as routine as an NDA.

While an experienced lawyer’s professional judgment will always be essential to dealmaking, that judgment is better applied to complex agreements, weighing strategic trade-offs, identifying key diligence risks, and advising clients and business partners. Making recurring revisions to routine contracts is simply not the highest and best use of their time and energy.

That’s why using purpose-built software that integrates technologies like Open AI’s GPT-4 is so important right now. AI contract automation enables deal and legal professionals to spend less time bogged down by the demands of high-volume, routine contracts like NDAs and more time focusing on mission-critical strategic work.

Firms equipped to move faster than their peers and spend less money while still adhering to high standards will be better positioned for success. Alternatively, market participants that are slow to adapt risk sacrificing results and performing like baseball’s “old-school scouts.”

The best way to deploy GenAI

Forward-thinking private fund managers recognize the opportunity GenAI presents, and many are considering how to deploy this technology within their firms.

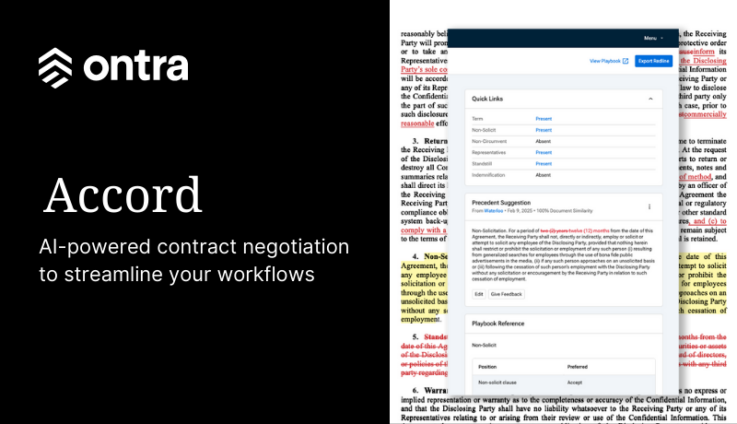

Firms may be tempted to develop their own software tools in-house or leverage a general-purpose AI tool. However, after hundreds of hours developing, testing, and fine-tuning AI designed specifically for private market contracts, we believe using an industry-specific tool like Ontra’s Contract Automation platform or Accord software solution is the best option.

Looking back, AI for contracts was slow to develop. Contracts are hard to read for a number of reasons — length, complexity, passive voice, defined terms — I could go on. Humans, even lawyers, have difficulty reading, understanding, and retaining information from contracts, so it was no surprise that AI struggled to understand them, too.

Eventually, natural language processing (NLP) techniques improved, computing capability grew, and underlying data sets expanded, meaning AI is well-equipped to tackle legal documents as long as it is properly trained, focused, and calibrated.

While there are many SaaS products focused on contract management for a variety of industries, Ontra is hyper-focused on the private capital markets. We are measuring, calibrating, and fine-tuning AI specifically for private fund legal workflows to provide richer insights, smarter automation, and a more intuitive user experience. In developing our Contract Automation platform, we’ve also collaborated with experienced lawyers around the world, giving our customers access to both advanced legal AI and human expertise.

By concentrating on solving a particular problem for a particular industry, Ontra has built end-to-end solutions for negotiating, storing, and analyzing routine contracts for private funds and private deals. Our solutions are powered by Ontra’s AI engine, Ontra Synapse, which combines proprietary machine learning models, Open AI’s GPT-4, insights from processing over one million industry contracts, and our global Legal Network.

What does it mean for private markets professionals to leverage an industry-specific AI tool like Ontra’s Contract Automation?

It’s simple. With Ontra’s Contract Automation or Accord, firms finalize routine agreements faster while achieving more consistent contract terms that ease the burden of obligation management and enforcement.

Instead of basing contract negotiations on one person’s experience, a firm’s contracts move through the Contract Automation or Accord platform, where the customer’s dedicated lawyer leverages AI-powered features to surface and consider data-backed market terms and the firm’s precedent and negotiation preferences.

Negotiating an NDA through Ontra’s AI-Powered Solution

Let’s take a look at negotiating a private equity NDA through Contract Automation, Ontra’s AI-powered SaaS solution.

Once an Ontra customer receives a new NDA for review, they simply forward it to a dedicated inbox. The lawyer processing the document marks up the NDA based on the customer’s playbook and precedent agreements, returning a first markup to the counterparty within 24 hours. Ontra’s AI-powered technology supports the process by suggesting edits based on precedent documents and the customer’s unique playbook, which the lawyer can accept or reject.

The customer’s playbook is crucial here. Ontra works with each customer to develop a tailored NDA playbook. Many customers choose Ontra’s standard playbook, which is based on years of experience negotiating NDAs in the private markets. If the customer has specific concerns or needs, the playbook can be customized to accommodate them.

Customers can also take advantage of their library of previously negotiated documents. Ontra’s solution surfaces previous markups for similar documents and overlays comments onto the new agreement for review. Both the playbook and Ontra’s Markup Builder feature drive speed and consistency across the customer’s NDAs.

Once the agreement is finalized, Ontra’s AI engine quickly summarizes the NDA terms, and the customer can access structured contract data through dynamic reports and analytics.

Accord, Ontra’s newest addition to its platform, offers the same user-friendly, end-to-end solution for in-house teams. With Accord, private fund managers can negotiate, analyze, and manage routine contracts faster and at a lower cost.

It’s time for legal to shed its old reputation

The legal industry can be slow to adopt new technologies. Lawyers tend to focus on their craft rather than researching and implementing new software. However, the efficiencies being driven by GenAI are becoming harder to ignore, and now is the time for agile lawyers to support their business teams by considering new approaches.

AI contract automation is to private fund lawyers what data analytics was to baseball scouts.

New technologies are making lawyers better at their jobs. AI contract automation does not replace experience and judgment. Rather, it provides deal and legal professionals with the time and energy they need to focus on strategic work and the information they need to make the best possible decisions for their teams.