With intense scrutiny from the U.S. Securities and Exchange Commission (SEC), it’s become obvious that private fund managers’ traditional methods of handling compliance aren’t enough anymore. Massive spreadsheets and manual tasks are time-consuming and leave too much room for error, particularly as side letters become more common and complex.

As a private fund adviser, you have to find the technology tools, processes, and procedures that make proactive compliance possible. If you don’t embrace a high-tech way of doing things, your firm could run the risk of an SEC enforcement action.

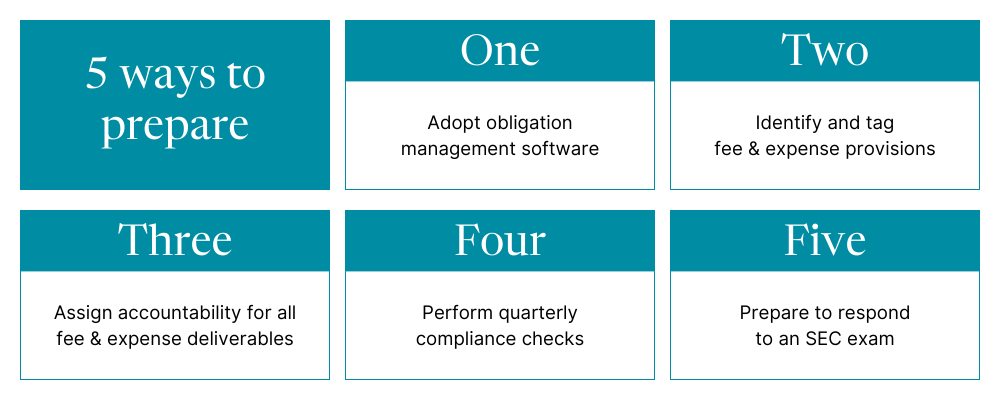

5 ways to prepare for increased fee & expense scrutiny

1. Adopt obligation management software

You’ll want industry-specific legal tech to support your compliance workflows. Insight from Ontra is the AI platform powering the private fund lifecycle providing greater transparency into your fund documents, streamlining your compliance workflows, and easing the process of responding to an SEC exam.

2. Tag fee & expense provisions in side letters

Insight’s tagging feature is crucial to your investor obligation and regulatory compliance workflows. You can search and label fee and expense-related provisions across all side letters for all funds, establishing a quick way to monitor the differences among your limited partners (LPs).

3. Assign accountability for all fee & expense deliverables

Ensure your firm delivers on its fee and expense obligations to investors and the SEC by using Insight’s Task and Subtask features. Insight lets you create multi-stakeholder workflows by assigning one-time and recurring tasks. As individuals mark tasks complete, your firm gains an auditable, time-based log of events documenting its compliance processes.

4. Perform quarterly compliance checks

Your new processes demand monitoring; otherwise, you run the risk of not fully implementing the plan you put to paper. Perform quarterly compliance checks with regard to fee and expense provisions. Consistent monitoring is an effective way to ensure your firm provides necessary disclosures and statements to investors.

5. Proactively prepare to respond to the SEC

You want to be able to respond to an SEC request for documents quickly and comprehensively. To prepare for an SEC exam, document the policies and procedures related to fee and expense allocation and maintain a digital record of compliance that your firm can easily share with regulators. You can export fund documents and data from Insight in just a few clicks to establish your side letter compliance.

The SEC wants proactive compliance

The SEC’s own language speaks directly to the need for general partners (GPs) to adopt a proactive compliance program that encompasses identifying all relevant fee and expense provisions, assigning accountability for associated deliverables, and maintaining a comprehensive audit trail of compliance with such provisions. However, due to the nuanced and complex nature of fund documentation, historically, you haven’t had a dedicated tool to help you efficiently and effectively manage your investor obligations and compliance workflows.

With Insight by Ontra, you can organize and actively manage obligations to your investors across all your funds in one centralized platform. Purpose-built to address the exact needs of GPs and the unique complexities of private funds documentation, Insight enables you to easily upload fund documentation, search and label obligations, and assign owners to key workflows.

Leading GPs already use Insight to optimize their fund and regulatory compliance programs, drive organizational accountability, reduce regulatory risk, and strengthen investor relationships. Don’t fall behind when compliance matters most.