The AI Platform Powering the Private Fund Lifecycle

Insight modernizes fundraising and simplifies compliance.

Request DemoInsight modernizes fundraising and simplifies compliance.

Request DemoInsight allows you to expedite your fundraise, run a modern MFN election process, and demonstrate side letter compliance.

Use innovative technology to keep legal expenses low when fundraising and meeting contractual obligations.

Demonstrate your ability to reduce errors and get audit-ready in the face of increasing regulatory scrutiny.

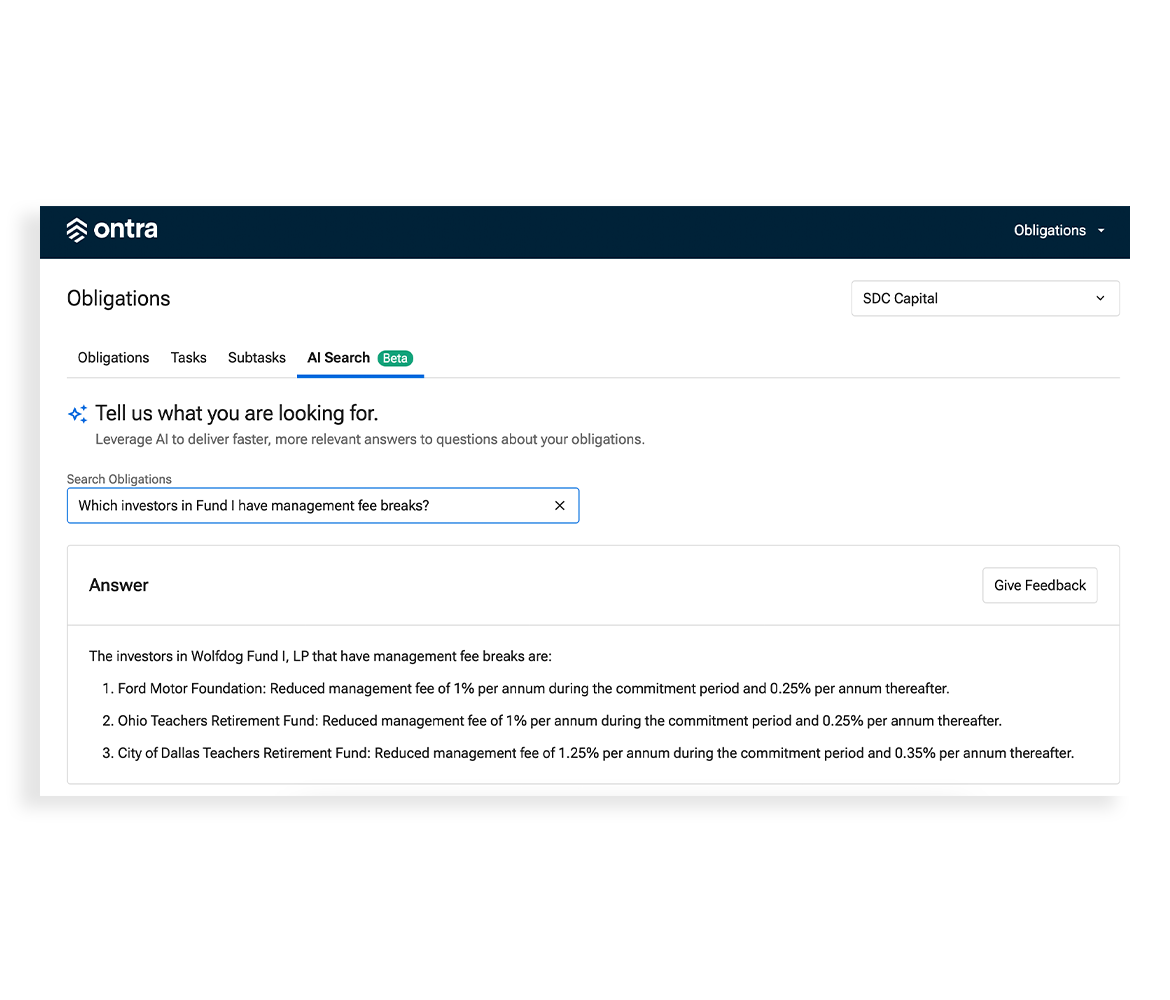

Leverage AI to automate strategic tasks in the fund lifecycle and don’t get left behind.

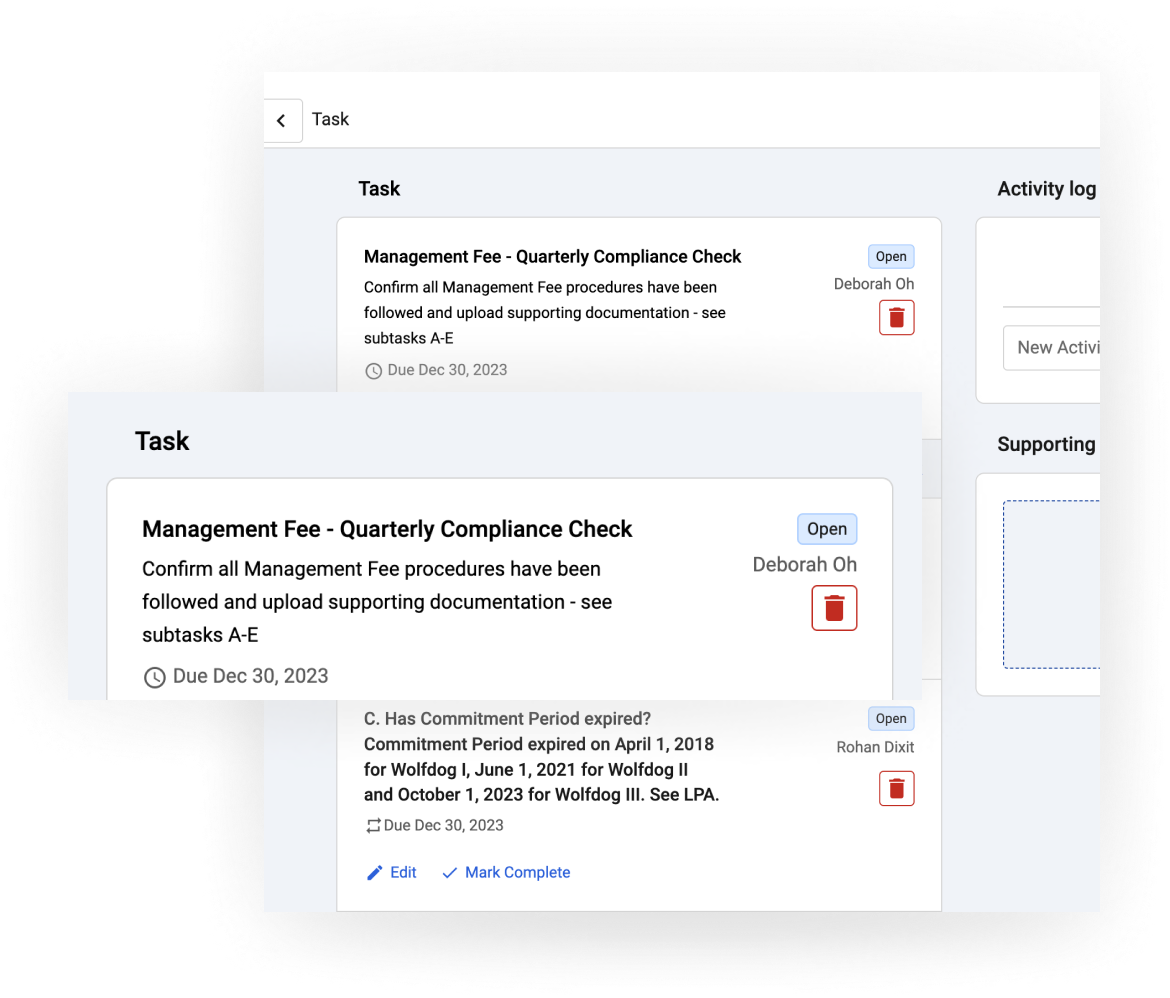

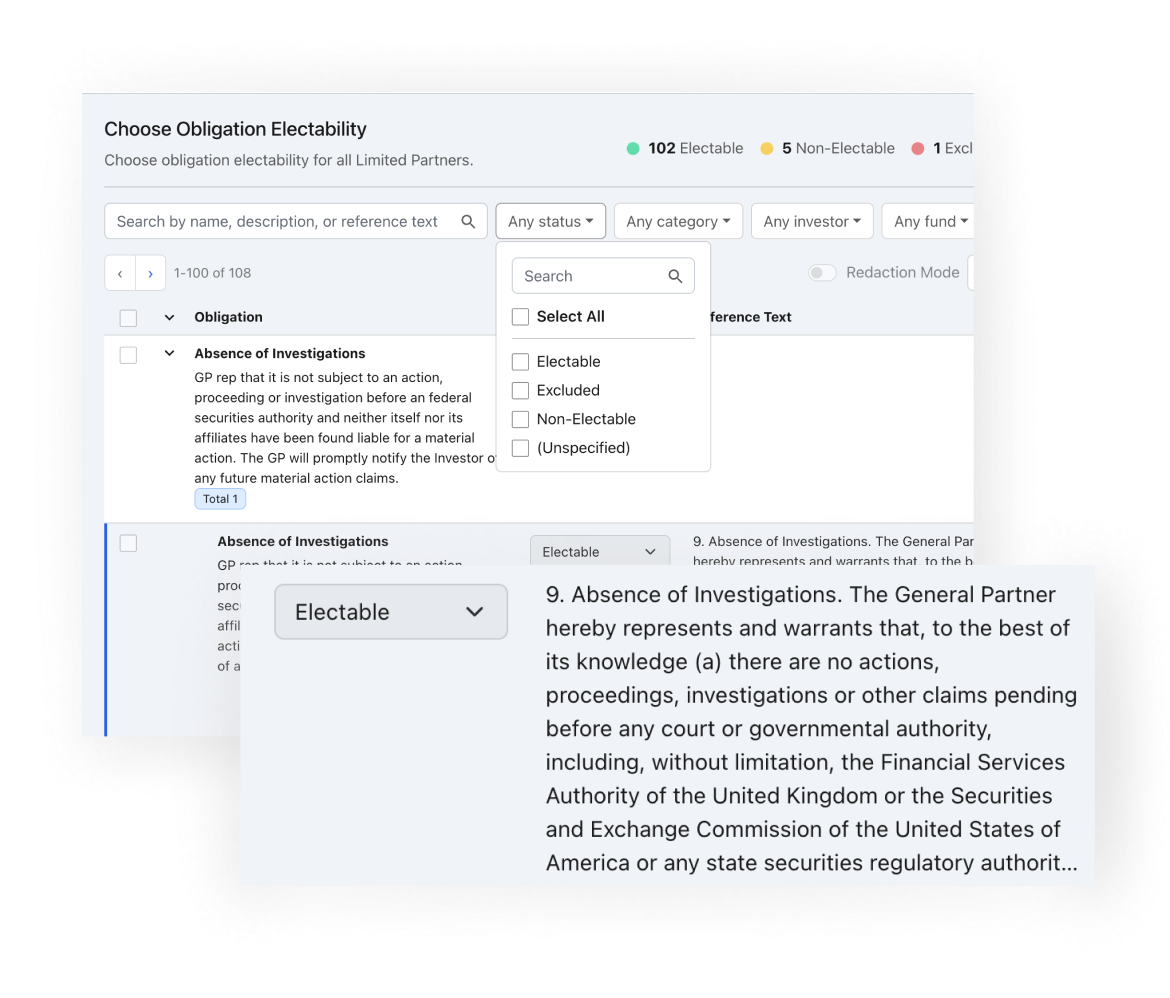

Gain real-time visibility into MFN elections and compliance by digitizing investor and legal workflows.

Leverage industry-leading AI models to identify and categorize clauses from fund documents in seconds.

Simplify and expedite MFN elections and disclosures.

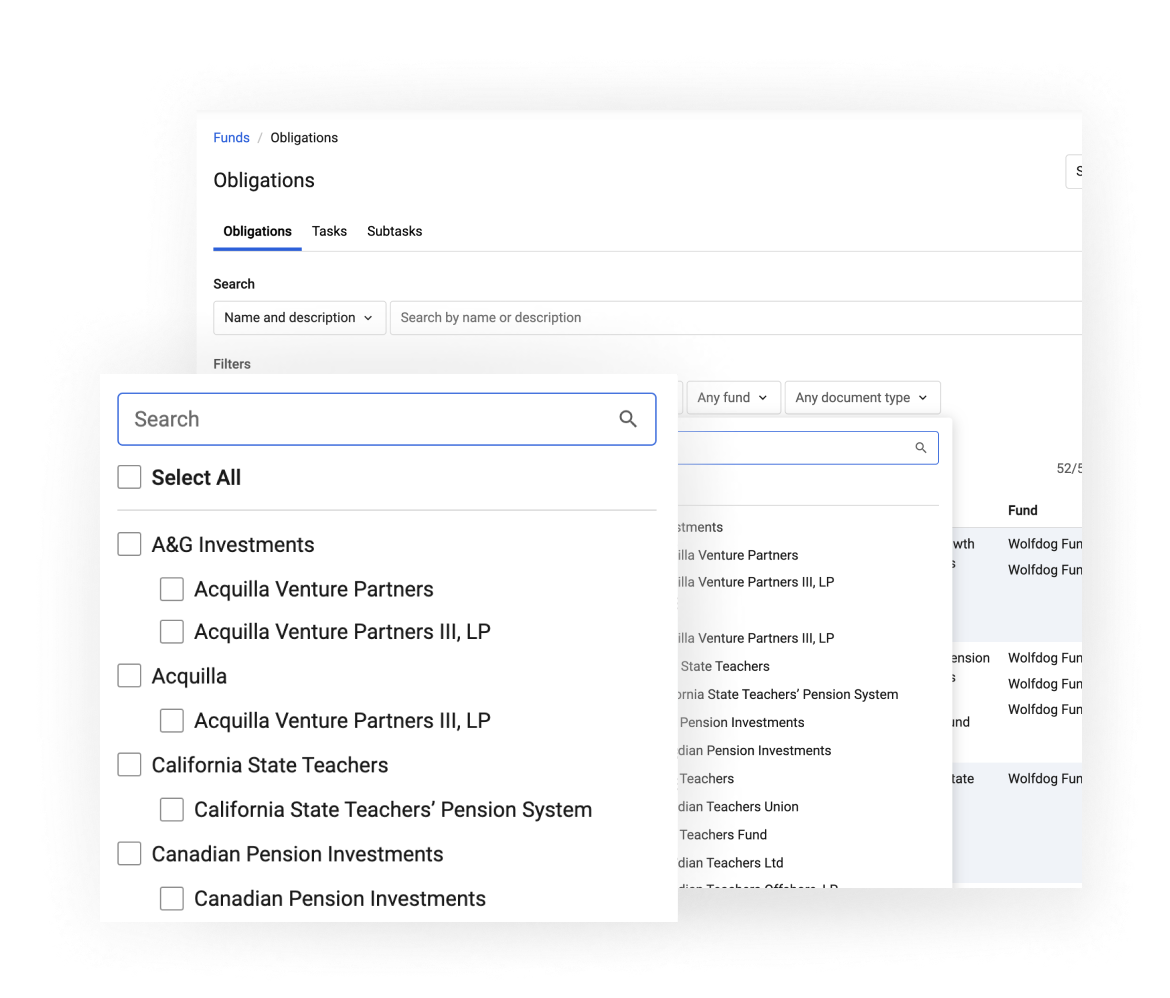

Easily search, assign, and report on obligation compliance efforts.

“In the three years we’ve partnered with Ontra, their Insight solution has helped ensure we’re in compliance with all of our contract obligations. We’re incredibly pleased with Ontra’s use of cutting-edge technology to deliver legal solutions optimized for quality, speed, and low cost. Adding AI in the mix with Ontra Synapse is another win for a company with a long track record of innovation.”