Hidden dangers within the private equity non-disclosure agreement (NDA) process can delay or ruin a possible deal. A mismanaged private equity NDA negotiation could prematurely push a seller or buyer out of the deal process despite the benefits of the potential transaction. Fortunately, that outcome is avoidable with Ontra’s Contract Automation solution.

What is a poorly managed private equity NDA process?

Private markets firms and investment banks may characterize a mismanaged NDA process as numerous rounds of revisions, strong disagreements over requested provisions, delayed responses to calls and emails, or an overall slow turnaround time.

Internally, firms and banks might struggle with assigning ownership of NDAs and responding quickly to communications due to their in-house lawyers’ and junior banking or deal professionals’ workloads.

Let’s take a closer look at the risks inherent in a poorly managed NDA process and how a digital transformation helps asset managers and investment banks avoid them.

3 hidden dangers in the private equity NDA process

1. Slow NDA turnaround times delay due diligence

An inefficient NDA process puts asset managers at a disadvantage in terms of gathering material information and competing with other firms.

After asset managers establish private equity fund strategies and begin sourcing deals, they want the ability to efficiently transition from interesting teasers to NDAs. Managers are most concerned with their ability to conduct due diligence promptly, which requires a quick NDA turnaround.

Unfortunately, many circumstances can hinder NDA execution including:

- A lack of clear internal processes and ownership of the NDA on either the buyer’s or seller’s side.

- Waiting on general counsel or an outside law firm to answer questions.

- Lacking an efficient collaboration environment or contract management solution to execute the NDA.

While an investment bank’s delay might equally disadvantage numerous PE funds, a buyer’s inefficiencies put it at a disadvantage compared to managers that turn around NDAs quickly and gain access to the target company’s data room sooner.

2. Poorly managed NDA negotiations create reputational risk

A private equity NDA often sets the tone for what it will be like for the two parties to work together. A challenging process can create a preference in a seller to work with a different asset management firm or for a manager to walk away from a target company and pursue a different deal.

Depending on an asset manager’s processes and internal bandwidth to manage a high volume of NDAs, the firm might rely on deal professionals or outside counsel to negotiate these agreements. Both situations can have negative consequences.

Unprepared deal professionals might not fully consider future risks to the firm when agreeing to NDA provisions. Outside counsel might be better prepared to consider risk but are often unresponsive, fail to understand terms material to the business teams, or are too rigid during negotiations.

From an investment bank’s perspective, a poorly managed sell-side NDA process could increase clients’ risks and drive up costs. If overall deal execution falls short of clients’ expectations, it hurts the bank’s reputation and might damage its future business prospects.

3. Rigid NDA terms can prematurely end the deal process

A party out of touch with current market dynamics and unwavering in its demands can knock itself out of the deal process prematurely.

For example, an asset manager might call for particular terms, such as a residuals clause, that a target company would reject. Or an investment bank might include provisions that raise red flags for potential buyers, such as:

- Limiting a manager’s conversations with industry contacts

- Requiring too long of a duration

- Demanding an over-inclusive non-compete provision

- Including a unilateral attorney’s fees provision

- Choosing an inappropriate state for governing law and venue

Either party’s refusal to consider reasonable alternatives may be the death knell for a potential deal. Consequently, there’s one less potential bidder in the investment bank’s auction process, and the manager has one less deal to consider in an already highly competitive market.

How to mitigate risk in the private equity NDA workflow

By digitally transforming internal processes and contract management tools, asset managers and investment banks can efficiently manage a high volume of NDAs.

Formalize the NDA workflow

Firms can improve the speed at which they turn around NDAs through several tactics. The first is to develop a defined process, including determining ownership, decision-making power, and escalation points.

At this stage, it’s essential to evaluate the organization’s bandwidth to manage NDAs. Defining the NDA workflow won’t speed up the process if the firm or bank continues to overburden in-house resources or rely on outside counsel.

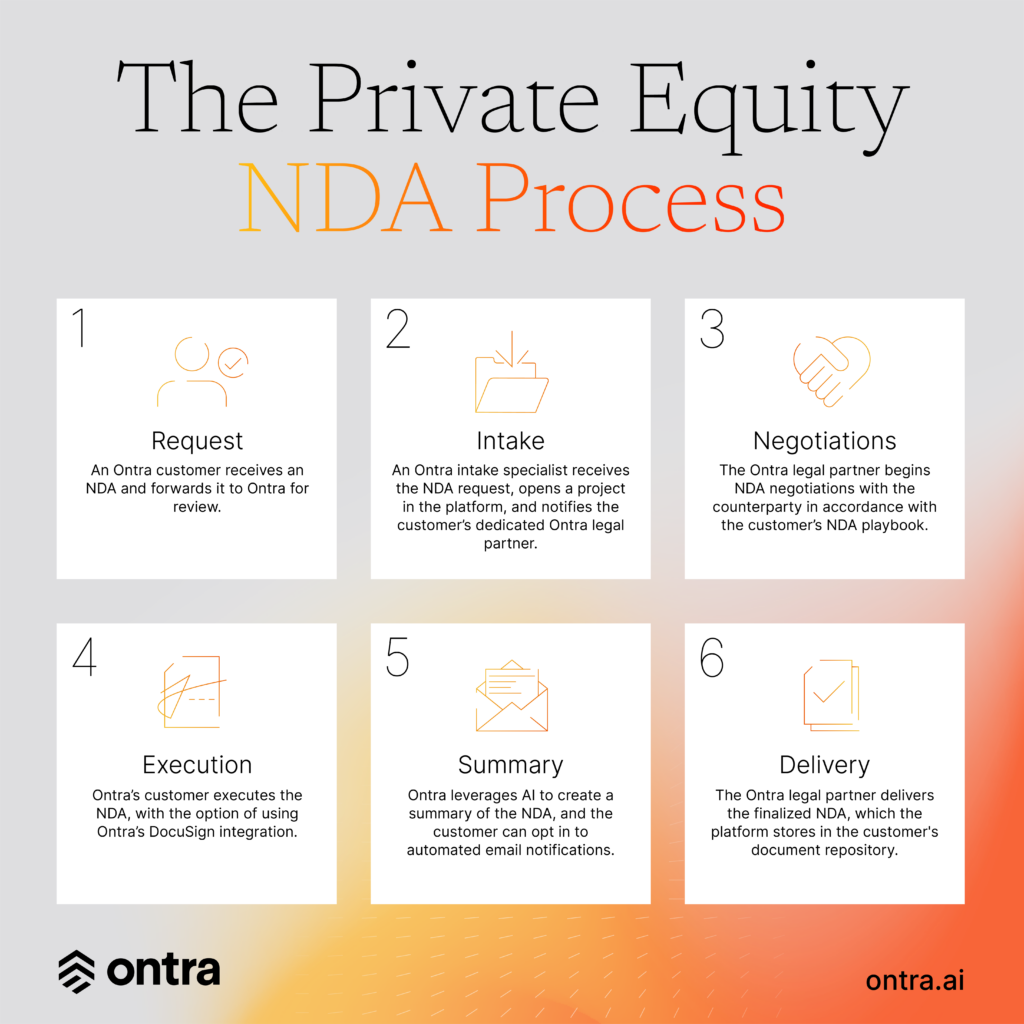

Organizations should consider legal outsourcing when routine agreements pull in-house lawyers or business professionals away from mission-critical work. Ontra’s human-in-the-loop Contract Automation solution combines artificial intelligence and a global Legal Network of independent lawyers who reliably process NDAs in a short turnaround time.

Adopt legal technology

Another tactic for improving speed and efficiency is adopting contract management software. Ontra’s Contract Automation solution is a superior way to negotiate, execute, and manage routine agreements. Equipped with AI-powered software and digital contract playbooks, Ontra’s in-network lawyers quickly and efficiently negotiate NDAs for buy- and sell-side customers.

With this digital transformation, asset managers and investment banks gain a centralized document repository, a collaboration environment, contract status tracking, automatic notifications, eSignature integration, and the ability to analyze and report on their contract data. With the help of contract AI, the platform offers a smoother experience for all parties involved.

Prioritize consistency & professionalism

Both asset managers and investment banks consider NDAs to be routine contracts, and they may underestimate an NDA’s importance at the beginning of a new relationship. While a mismanaged NDA process can tarnish an organization’s reputation, an efficient process can boost it.

It’s helpful to put NDAs in the hands of lawyers who can see them through from start to finish. Organizations that don’t have the bandwidth to insource NDAs or the desire to pay expensive outside counsel can gain consistency through a legal outsourcing provider. While in-house counsel and business professionals focus on high-value tasks, freelance lawyers can quickly respond to stakeholders’ questions and concerns.

Use reasonable, on-market terms

Managers and banks can foster an efficient process through an NDA playbook that outlines preferred and fallback terms. When establishing the contract playbook, organizations have the opportunity to review what is commercially appropriate.

Ontra provides three tiers within Contract Automation, ranging from predefined playbooks based on market terms to fully customizable terms. Ontra’s legal network members have collectively processed one million agreements. This deep experience can offer unique insights into the market that other platforms can’t provide.

Additionally, Ontra’s Contract Automation solution enables managers to monitor terms across their NDAs. Keeping track of these terms enables firms to leverage historical terms in future negotiations.

Investment banks can do the same. Insight into previously accepted terms lets them pursue consistent, reasonable terms in NDAs for the same deal and for future clients.

Optimize private equity NDA processing with Ontra

A high volume of NDAs is simply one consequence of the increasing deal competition in the private markets. Ten years ago, private markets firms and investment banks could afford to rely on manual processes and internal resources to negotiate and execute fewer NDAs. Now, they know a digital transformation is essential to optimize manual processes, make faster, data-driven decisions, and build a competitive advantage.

Ontra’s Contract Automation is a SaaS solution powered by our proprietary AI engine, Ontra Synapse. We combine purpose-built machine learning models, Open AI’s GPT-4, data from one million contracts, and a global network of independent legal professionals to deliver AI outputs specific to the private markets’ legal workflows. We work with leading private markets firms and investment banks to efficiently deliver consistent, high-quality NDAs.