Side letter management has become increasingly challenging for private fund managers as LPs have the upper hand in the current fundraising environment. LPs can require significant due diligence efforts and request bespoke fund terms. In many cases, side letters are growing longer and more complex to address LP demands.

Between 2005 and 2014, the average number of terms in a side letter grew from 3 to over 31. Over a decade later, there’s no sign that side letters have decreased in popularity or slimmed down, given intense fundraising competition and LPs’ ability to be selective and negotiate terms. As a result, private fund managers are navigating compliance across dozens, if not hundreds, of side letter obligations.

Ultimately, private fund managers’ previous processes and legacy tech aren’t keeping up with the complexity of today’s side letter management. The old way of relying on spreadsheets, Ctrl+F, and someone’s really good memory is out. The new way means leveraging purpose-built AI solutions and gaining a competitive advantage through innovation, enhanced compliance, and strong investor relationships.

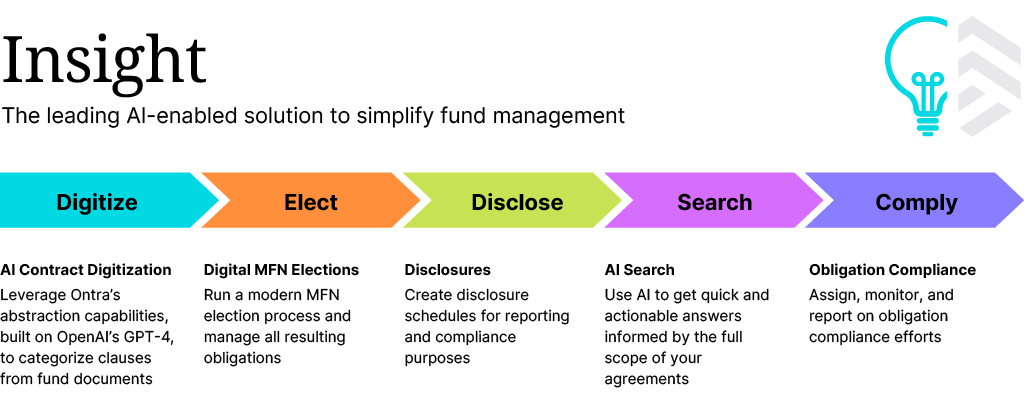

Insight from Ontra provides industry-leading AI abstraction and search capabilities to help private fund managers understand their agreements, track upcoming deliverables, and meet commitments to investors — all in one place.

Traditional side letter management weaknesses

Delayed compendia

Managers have traditionally relied on massive compendia that take months to build and become out of date quickly to manage their investor obligations. In a survey by Ontra and Wakefield Research, 43% of asset managers said it took four to six months to get a compendium of key fund documents and side letter terms.

Compliance risk

During the months without a compendium, firms might not be aware of all their obligations and face a significant risk of noncompliance. Once managers receive a compendium, they can finally start identifying their obligations to investors and assigning related tasks to internal stakeholders. The challenge is that most firms lack a digital way to identify, assign, and complete these tasks.

Inadequate search

With traditional processes — like the catch-all Ctrl-F — it’s difficult for fund managers to identify particular provisions and obligations across a fund, let alone multiple funds. Once they find the information they need, they have to separately and manually review their contracts and, in many cases, consult with outside counsel about what the firm has agreed to.

Ad hoc processes

To comply with their obligations, stakeholders often string together spreadsheets, calendar reminders, emails, tabbed binders, and even Post-it notes. Unsurprisingly, Ontra found 77% of our survey respondents worried at least once in the past year about failing to comply with investor obligations. Failing to deliver on an investor obligation could result in costly and time-consuming remedial work, damaged relationships, regulatory penalties, and front-page headlines.

Ontra’s AI-enabled obligation compliance

Insight from Ontra digitally transforms firms’ LPA, side letter, and obligation management processes to tackle these weaknesses.

Insight provides managers with a single source of truth for their fund documentation and investor obligations. Within the platform, internal stakeholders have immediate access to their contract data and can proactively manage investor obligations by assigning and tracking internal compliance with tasks.

Digital compendia

With Insight, firms gain a centralized digital repository of all their LPAs, side letters, and other documents across funds, with their obligations accurately summarized and categorized for easy access. Ontra’s AI-enabled software extracts, digitizes, and categorizes contract commitments. Through a blend of industry-leading algorithms and human-in-the-loop oversight from a network of experienced industry lawyers, firms transform fund documentation into structured data.

AI Search

Users can leverage AI to get quick and actionable answers informed by their agreements in Insight. They simply ask Insight questions about their agreements and receive a detailed response in seconds that surfaces and summarizes relevant information. They can explore the answer’s supporting obligations with links to reference text and summaries and even leverage the search results to create tasks.

Comprehensive redlining

In-house professionals can use the SmartLine redlining feature to compare unlimited provisions to a designated base provision. They can group similar terms together in SmartGroups while also quickly identifying key differences in similar contract terms. This feature also enables firms to analyze precedent terms to gauge consistency across contracts and identify off-market positions.

Digital MFN elections

Users can quickly create forms using commitment thresholds and investor characteristics to determine the display of electable provisions and disclosures. They can send forms and then review their investors’ elections in a single digital platform. Once the firm accepts an investor’s elections, the new obligations are seamlessly reflected in Insight.

Digital disclosures

Firms can create disclosure schedules for reporting and compliance purposes, redact confidential information, and distribute reports.

APIs

Firms can instantly access, create, and modify mission-critical data across internal and external applications with Ontra’s APIs. Users can configure workflows across platforms to automatically trigger actions and enhance reporting.

Multi-stakeholder task workflows

Insight provides multi-stakeholder obligation workflow tools through which firms can assign tasks and subtasks, monitor stakeholders’ actions, and report on their contract compliance efforts. Stakeholders can designate ownership of one-off and repeatable tasks and set alerts to notify owners when tasks are due.

Benefits of digital side letter management

- Better manage risk: Demonstrate your ability to reduce errors and satisfy commitments to counterparties.

- Increase transparency: Gain real-time visibility into fundraising and compliance, and quickly understand which terms are standard for your firm.

- Reduce expenses: Leverage innovative technology to keep expenses low when monitoring and delivering on commitments.

- Embrace innovation: Stay competitive by using AI to digitize fund documents and automate compliance workflows.

Don't miss Ontra's expert insights

Join our newsletter to stay up to date on features and releases

By subscribing you agree to our Privacy Policy

Thanks!

Better side letter management and LP relationships with AI

Private fund managers often take pride in their operating expertise and ability to avoid compliance pitfalls. But if they’re being honest, they’ve probably lost sleep at night over worrying about a missed obligation. Private markets firms incur unnecessary risk and expense when they rely on manual processes and off-the-shelf solutions to track and manage their commitments to counterparties. These traditional workflows and worries place considerable stress on the in-house deal, legal, and compliance professionals’ shoulders.

With Insight, internal stakeholders can spend less time reacting to obligation management tasks and more time focusing on fundraising and investing. Firms can gain a competitive advantage in the private markets by improving compliance with investor obligations, reducing exposure to regulatory penalties, and creating space to focus on returns.