The U.S. Securities and Exchange Commission (SEC) has focused on advisers to private funds for years. The scrutiny began after regulations changed to require most private equity funds to register with the SEC and continued as the private markets grew significantly. According to the SEC’s most recent Private Funds Statistics, the number of private funds hit 47,443 by Q2 2023 compared to 43,428 the year before. As of December 1, 2023, dry powder reached $2.59 trillion, according to S&P Global Market Intelligence and Preqin data.

Given the SEC’s focus on the private markets, firms must be conscientious about ongoing filing and reporting obligations. They must also be prepared to provide accurate information to the SEC and cooperate with an exam. Anything less could lead to deficiencies and fines as well as damage the firm’s reputation with investors.

The best way for private fund managers to maintain accurate records and prepare for an SEC exam is to use advanced legal technology. Insight by Ontra is an AI platform built to help fund managers proactively manage the contractual obligations in their fund documentation. It replaces ad hoc tools, giving managers a central location to track their investor obligations, assign ownership of tasks, and build a comprehensive audit trail. Reach out to learn more about Insight.

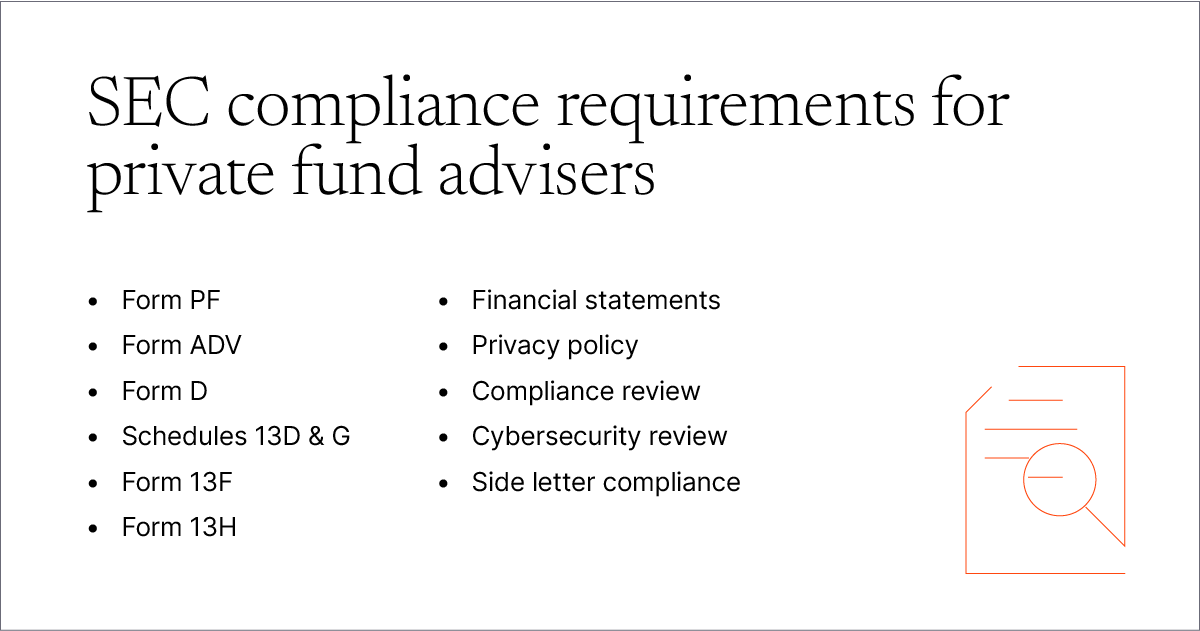

Below, we’ve summarized some key SEC filing and reporting obligations for private funds. Consult your legal counsel for more detail.*

SEC reporting requirements for private fund advisers

A. Public reporting to the SEC

Reporting Form for Investment Advisers to Private Funds, Form PF

The SEC has amended Form PF several times in recent years, with the newest amendments adopted in February 2024. Form PF provides the Financial Stability Oversight Council with data to help it gauge trends and risks in the U.S. financial markets.

All SEC-registered investment advisers that manage any number of private funds with at least $150 million in private fund assets under management as of the adviser’s most recent fiscal year-end must file Form PF on a quarterly or annual basis. Additionally, all private equity fund advisers must file a quarterly event report after certain trigger events.

Large hedge fund advisers — those with over $1.5 billion in hedge fund AUM — must file Form PF within 60 calendar days after the end of each quarter and as soon as applicable, but no longer than 72 hours, after certain trigger events. Other advisers must file within 120 days of the end of their fiscal year.

The relevant investment advisers can use the Private Fund Reporting Depository to file the initial Form PF and updates.

Uniform Application for Investment Adviser Registration, Form ADV

Registered investment advisers must file Form ADV with the SEC and update it annually within 90 days of the adviser’s fiscal year-end or in the event of material changes. Part 1 of the form requires information regarding the adviser’s business, ownership structure, clients, business partners, affiliations, and more.

Part 2 requires advisers to disclose their business practices, fees, conflicts of interest, and disciplinary information in plain English. Advisers must also deliver Part 2 to their clients and make the brochure available to the public through adviserinfo.sec.gov.

Notice of Sale of Securities, Form D

Some advisers may need to file a notice of an exempt offering of securities with the SEC. The SEC requires advisers to file the notice when they sell securities exempt from registration under the Securities Act of 1933 in an offering under Rule 504 or 506 of Regulation D or Section 4(a)(5) of the Act.

The SEC requires advisers to file the notice within 15 days after the first sale of the securities in the offering. Advisers that are actively fundraising must file annual amendments to Form D.

The SEC may also require unregistered advisers to file Form D if the advisers rely on Reg D to offer exempt securities.

Beneficial Ownership Reports, Schedules 13D & G

Private equity funds holding equity securities in public companies may have additional reporting requirements, including Schedules 13D or G, Form 13F, and Form 13H.

Funds that acquire more than 5% of a class of public equity must file a Schedule 13D. Alternatively, the fund or adviser may be eligible to file a Schedule 13G, an alternative with fewer reporting requirements, if they meet certain exceptions.

In October 2023, the SEC shortened the deadlines for filing Schedules 13D or G and required both filings to use structured, machine-readable data language. Funds will soon have five instead of 10 business days to file an initial Schedule 13D and two business days to file amendments. Filing deadlines for Schedule G vary but are generally shortened.

Compliance with the revised Schedule 13G filing deadlines begins on September 30, 2024, while the structured data requirement for Schedules 13D and 13G takes effect on December 18, 2024.

Form 13F

Advisers with investment discretion over equity securities in public companies must electronically file Form 13F within 45 days of each quarter-end. Generally, advisers are required to file if funds they advise collectively own more than $100 million of Section 13(f) securities on the last day of any month during the calendar year.

Form 13H

Large traders must file Form 13H. The SEC defines large traders as a firm or individual whose transactions in national market system (NMS) securities are equal to or more than two million shares or $20 million during any calendar day or 20 million shares or $200 million during any calendar month.

B. Private reporting to investors

In addition to Part 2 of Form ADV, the SEC requires advisers to make certain reports to their clients.

Audited financial statements

Within 120 days of the end of the fund’s fiscal year, advisers must deliver audited financial statements to their investors. An independent public accountant registered with the Public Company Accounting Oversight Board must audit these statements. Additionally, advisers typically have annual and quarterly reporting requirements defined in their fund documentation.

Privacy policy

Registered investment advisers must provide all clients who are natural persons with a summary of their privacy policy every year. There are some exceptions: Advisers don’t have to provide their privacy policy if they don’t share nonpublic personal information with non-affiliated third parties, and their policies haven’t changed since the last privacy policy distribution.

C. Additional compliance requirements

Advisers face other requirements that don’t necessitate a specific filing.

Compliance review

Registered investment advisers must review their compliance policies and procedures each year. Best practice is to document this review and your findings in writing.

For guidance on key focus areas for the SEC, advisers can review an October 2021 Risk Alert that includes the Division of Examination’s observations on frequent deficiencies. When advisers conduct reviews, they should carefully document their compliance practices and the outcomes.

Cybersecurity review

The SEC is focused on cybersecurity and included it in its most recent 2024 Examination Priorities. All advisers should carefully review their cybersecurity policies and, if necessary, create or improve them. Advisers can consult the SEC’s August 2017 Risk Alert for guidance.

Side letter compliance

Advisers are often subject to additional investor reporting obligations as a result of their specific fund documents and side letter agreements. While a securities law may not explicitly require these reporting obligations, the SEC expects advisers to honor their contractual obligations to investors. Part of the SEC’s increased scrutiny in recent years is ensuring advisers adhere to these agreements.

Private reporting to FinCEN

While not an SEC requirement, a new beneficial ownership reporting rule is an important piece of regulatory compliance for private fund advisers.

Beneficial ownership information

The Corporate Transparency Act’s (CTA) new reporting requirements went into effect on January 1, 2024. While most private fund entities will be exempt from this beneficial ownership information (BOI) reporting requirement, advisers and their legal teams have to perform CTA analyses first to find out.

Unless exempt, all U.S. domestic and certain non-U.S. legal entities must disclose information about themselves, their beneficial owners (including persons who exercise substantial control over the company), and up to two company applicants.

Legal entities existing as of January 1, 2024, have a full year to file a BOI report with FinCEN, while entities formed after January 1, 2024, have 90 days from formation to make their required filings.

SEC compliance challenges for private fund advisers

Managers need to diligently track filing and reporting deadlines to maintain proactive compliance programs. These frequent filing and reporting obligations force managers to continuously maintain updated and accurate information.

Unfortunately, managers often struggle with ongoing reporting requirements because they rely on traditional processes and ad hoc technology solutions. Many managers use manual processes and spreadsheets, which are prone to human error and make efficiently gathering data challenging.

Additionally, it can be time-consuming to maintain audit trails of the managers’ compliance efforts, particularly around contractual obligations, such as those found in fund documents and side letters. Part of the challenge of maintaining an audit trail is the inability to track internal responsibility for tasks. On a practical level, the inability to track internal tasks means important work can fall through the cracks. On a compliance level, the lack of visibility and the possibility of mistakes could complicate an SEC exam and lead to additional scrutiny or, in some cases, fines.

In the event of an SEC exam, managers should be able to quickly respond to requests and produce relevant documents. Inefficient processes, including manual obligation tracking, can slow down managers’ response times and impede their efforts to cooperate with the SEC.

A compliance tool for private markets

While there are effective technology solutions for tracking some aspects of advisers’ compliance programs, particularly regarding trading and gifting policies, a solution for proactively managing private fund agreements presented a challenge for years. That’s changed. Insight from Ontra is the AI platform powering the private fund lifecycle for managers that must comply with numerous provisions in their fund documentation.

By using natural language processing and other forms of artificial intelligence, Insight turns managers’ key agreements into structured data. As a result, managers can organize, search, and more easily comply with their commitments to investors. The platform becomes the single source of truth for investor obligations.

A crucial feature of Insight is the ability to respond to an SEC request for information with just a few clicks. Private fund advisers can download an overview of their fund documents and side letters, produce the underlying documents themselves, and generate a list of the general partners’ specific obligations to investors. These Insight exports mean advisers can supply the SEC with information about fund and side letter compliance swiftly and with minimal stress.

Ultimately, Insight eases the process of maintaining accurate information, complying with SEC reporting requirements, and cooperating with SEC exams.