The rising cost of LP Transfer Agreements is creating tension in the GP-LP relationship. Secondaries Investor recently reported on concerns surrounding the rising cost of LP transfers in the private markets, finding that some law firms are charging upwards of $100,000 for a single agreement.

While the investors typically share the expense, the rising fees come at a time when LPs (and the SEC) are keeping a close eye on GP fee and expense calculations and allocations. Investor relations teams are more likely than ever to hear their LPs are unhappy with their bill.

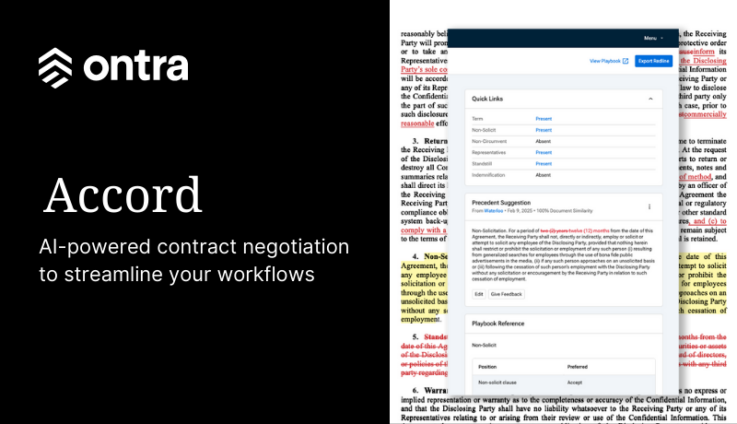

To improve the LP transfer process, reduce costs, and bolster GPs’ relationships with their investors, Ontra introduced LP Transfer Agreements to our Contract Automation solution. Now, our customers can streamline the negotiation, execution, and management of these agreements with the help of Ontra’s AI-powered legal tech and global Legal Network.

Overview of LP Transfer Agreements

An LP can transfer all or part of its interest and future obligations, including capital calls, to a new or existing LP in the fund. The GP must consent to this transfer in the LP Transfer Agreement — the document that codifies the terms between the LP transferor, LP transferee, and GP. The parties might sign an agreement in advance, but it will typically take effect on the last day of the quarter.

LP Transfer Agreements vary in complexity and length, and a GP’s outside counsel tends to handle the negotiations. In many cases, however, the agreements are repetitive and low risk for the parties, resulting in LPs paying unnecessarily high fees.

The rising costs of LP transfers

Secondaries Investor reported on concerns surrounding the rising cost of LP transfers in the private markets. Sources told the publication that the cost of LP Transfer Agreements typically ran between $5,000 and $10,000 for a single transfer, but the average cost is on the rise to between $15,000 and $20,000. Some law firms charge upwards of $80,000 or $100,000 for one transfer agreement.

Despite the repetitive, standard nature of many LP Transfer Agreements — often handled by associates and paralegals — some law firms are charging significantly more. Fees for the negotiation of the transfer agreement are typically split equally between the transferor and transferee. The fund’s counsel has considerable freedom in how much it charges given it doesn’t have a legal responsibility to the LPs and may have less oversight on costs from the GP.

The opposing view is that the cost of transfer agreements is rising alongside increasing complexity. Some law firms find that even such a repetitive agreement can require a great deal of time and effort, particularly to ensure the secondary transfer complies with the fund’s LPA and applicable regulations and laws.

Streamline LP transfers with Ontra’s Contract Automation

At the time of publication, Secondaries Investor noted there wasn’t yet a solution to streamline the LP transfer process and save the parties money. However, Ontra has introduced just that to the private markets.

GPs and LPs can leverage Ontra’s AI-powered process to negotiate, execute, and manage LP Transfer Agreements efficiently and at a lower cost.

Ontra’s Contract Automation solution is an AI-enabled contract negotiation platform that streamlines repetitive legal agreements, including buy- and sell-side NDAs, vendor agreements, non-reliance letters, and now LP transfers.

With our global Legal Network of independent legal professionals and AI legal tech, Contract Automation offers:

- Assistance with communicating information requests and compliance requirements

- Collaboration with external parties, such as tax advisors and fund admins, to ensure an efficient, on-time transfer

- Markup, negotiation, and execution of the LP Transfer Agreement and the option to negotiate associated side letters

- Secure document storage with detailed document reporting and search capabilities

Benefits of AI-powered LP Transfer Agreements

When GPs and LPs process transfers through Contract Automation, GPs:

- Reduce costs for their LPs

- Shorten the turnaround time for transfers

- Improve their responsiveness to transfer requests

- Strengthen their LP relationships

- Free their external counsel to handle higher-value tasks

Ready to improve the LP transfer process?

To learn more about Contract Automation and how Ontra can improve your LP transfer process, schedule a demo today.