Asset management firms have taken advantage of legal process outsourcing for decades. However, many firms continued to keep routine contracts in-house because of concerns that outsourcing legal work wouldn’t produce high-quality results.

Thanks to the transition of LPO into contract automation and intelligence, firms can put this worry aside. Legal process automation offers firms the technology and legal resources to outsource high-volume, routine contracts.

What is legal process outsourcing?

LPO occurs when an organization hires a third party, such as an outside law firm or service provider, to complete a legal task not central to the hiring organization’s business.

How has legal process outsourcing evolved?

Contracts are a great example of the evolution of LPO. Contract drafting, negotiations, execution, and obligation tracking are ripe for automation, given the number of repetitive tasks lawyers and their staff perform.

The transition from contract outsourcing to contract automation and intelligence relies heavily on access to high-quality data and human insight. Consequently, top legal process automation providers are developing human-in-the-loop technology. As these providers process more contracts, their models gather new information to learn from. Importantly, professionals using the platform approve or reject the model’s suggestions, providing a continuous feedback loop essential to strengthening the model’s accuracy.

Contract automation involves using digitization and natural language processing to “read” contracts. Currently, many solutions on the market rely on rule-based matching between texts. It’s a shallow technological solution, although it’s still helpful depending on an organization’s needs. Alerts to ambiguous or problematic language help firms mitigate risk and improve consistency across their routine contracts.

The truth is that machine learning within contracting is capable of much more. Advanced NLP models understand the true meaning of the text. Instead of using pattern matching, the technology can offer suggestions and take action based on the meaning of the contract provisions. These models offer a solution closer to true artificial intelligence.

Legal process automation features

Legal process automation is currently most effective for high-volume, routine contracts. Automation cuts through negotiations as parties rely on predefined contract playbooks and market standard terms.

Contract automation offers significant benefits, including:

- Contract creation

- Alerts and notifications

- Workflows and approvals

- Redlining and collaboration

- eSignatures

- Structured contract data

- Data analysis and reports

- Obligation tracking

In time, contract automation will do much more. It’ll offer additional support for lawyers negotiating complex, bespoke agreements, enabling them to focus on substantive aspects of the negotiations instead of repetitive manual tasks.

Advantages of legal process automation over traditional legal outsourcing

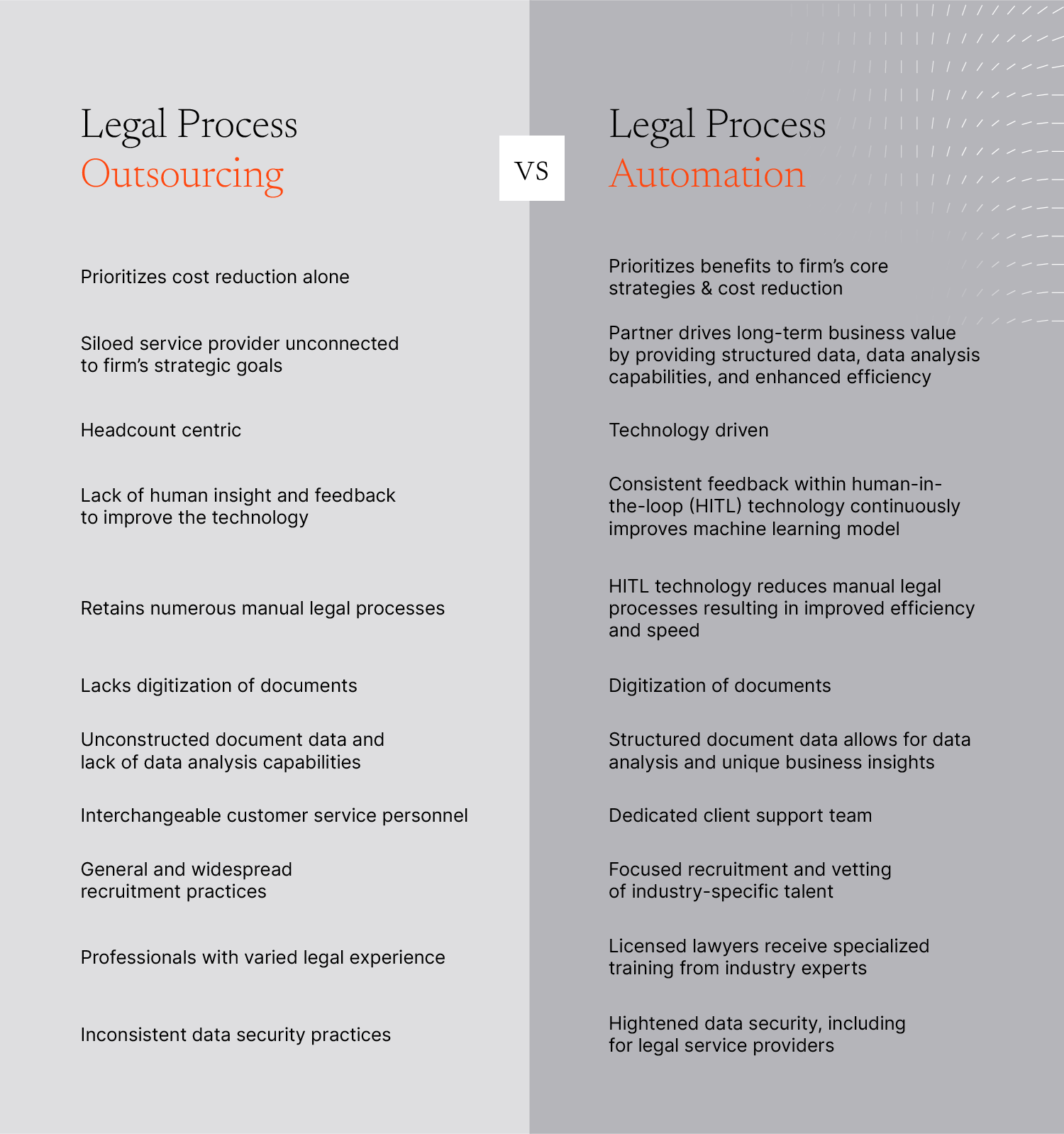

It can be challenging to envision the ways legal process automation differs from traditional outsourcing. Fundamentally, legal process automation focuses on advancing HITL and AI technologies to benefit lawyers and other business professionals. It’s not simply a low-cost service.

Additionally, contract automation and intelligence providers focus on building strategic partnerships with organizations rather than offering negotiations as a simple commodity. Vendors provide numerous benefits, including enabling firms to use structured contract data to inform negotiations and business decisions.

Which legal services do asset managers typically outsource?

Outsourcing was initially popular for back-office tasks, such as human resources and IT. However, the arrangement slowly moved into the middle and front offices.

Examples of outsourced activities include:

- Due diligence

- Contract negotiations

- Fund administration

- Compliance

Benefits of legal process automation for asset managers

Both traditional LPO and the new generation of legal process automation save firms money, which is essential. EY Law and the Harvard Law School Center on the Legal Profession found 99% of organizations surveyed in 2021 planned to reduce contracting costs over the next two years. But the benefits of taking advantage of contact automation and outsourcing go far beyond price.

Many asset management firms struggle with high volumes of routine contracts. They often assign this repetitive work to business associates who lack legal training or in-house lawyers who’d rather spend time on more strategic tasks. Firms also regularly lack contract templates, standard provisions, naming conventions, or storage procedures. This situation increases the risk of errors during contract creation and obligation tracking, which could harm the firm’s reputation.

Firms often recognize they need to improve their contract management processes. Yet most organizations aren’t well-prepared to upgrade their programs. EY Law and Harvard found 92% of organizations were transforming the way they handled contracts. However, 99% of organizations didn’t have the data or technology they needed to improve their contracting process.

Firms can gain the technology they need by working with a legal process automation vendor. Contract automation supported by experienced transactional lawyers offers a more efficient process, reducing contract turnaround times and speeding up dealmaking. New processes and technology require firms to reevaluate their routine contracts and put in place playbooks, preferred terms, and fallback terms. Ultimately, firms move on to the core negotiations of their transactions faster.

Contract automation with the right outsourcing partner improves contract consistency and risk mitigation. Firms can be confident that their routine contracts are consistent and less open to mistakes, given that outsourcing now involves a network of highly skilled transactional lawyers working within the framework of set procedures and terms. The right vendor also offers a centralized platform to ensure executed contracts are appropriately stored and searchable, drastically improving ongoing obligation tracking.

Additionally, contract automation technology saves firm employees time and energy. In-house lawyers and business associates are now free to focus on work central to the firm’s strategies.

What to look for in an LPA provider

For private asset managers to take full advantage of legal process automation, they first have to connect with the right vendor. Firms can find a strategic partner by taking a mindful approach based on the firm’s pain points and preestablished vendor criteria. The firms can base their final decision on scorecards that account for a vendor’s people, products, services, and business resiliency.