Alternative legal service providers (ALSPs) are playing an increasingly valuable role in providing advanced legal tech and legal outsourcing services to various industries, including the private markets. With the right ALSP in their corner, asset managers can tap into a range of benefits, including improving process efficiencies, increasing cost savings, and freeing up internal resources to focus on mission-critical tasks.

However, managers interested in reaping the benefits of partnering with a legal technology provider will find an abundance of options on the market. Although engaging a first-rate ALSP can be a relatively simple process, selecting the right provider capable of meeting the firm’s needs isn’t always straightforward.

Given the number of legal tech providers and ALSPs in the market and the unique needs of private fund managers, firms need to know how to identify the most suitable solutions provider for them and lay the groundwork for an effective relationship.

Discover how Ontra is becoming the leading ALSP for private markets firms with a demo of our legal operating system.

7 benefits of working with an alternative legal service provider

1. Additional legal support

Many ALSPs offer access to legal professionals through an alternative employment model. Asset managers can access freelance lawyers and other legal professionals in the U.S. or abroad through an ALSP’s legal network.

2. Specialized legal knowledge

Some circumstances call for legal expertise a firm’s in-house legal department can’t provide. Instead of hiring another in-house lawyer or going to outside counsel, the firm might find that knowledge through an ALSP. This is particularly helpful when a business needs to access a combination of legal expertise and a software solution.

3. Purpose-built legal tech

Because many ALSPs more closely resemble legal tech companies rather than law firms, they’re often the right place to look when an asset manager is interested in a software solution for a legal task. Many ALSPs are on a mission to optimize manual and time-consuming legal tasks and offer legal process automation solutions.

4. Less reliance on outside counsel

Through a combination of technology and access to experienced legal professionals, asset managers can call on their outside law firms less often. With access to more efficient legal solutions, managers can reserve outside counsel for more unique, strategic, and high-risk situations.

5. Lower legal spend

By engaging outside counsel less and using legal tech to optimize legal tasks, asset managers may be able to reduce how much they spend on legal services.

6. Faster, more efficient processes

ALSPs aren’t merely focused on providing legal support at a lower cost. In many cases, these companies are dedicated to improving various manual, repetitive, and time-consuming legal tasks. For example, contract automation software coupled with a global network of freelance lawyers can drastically speed up the turnaround time for a private equity non-disclosure agreement.

7. Scalability

A common challenge for in-house legal departments is scaling up or down depending on the demand for their legal services. Working with an ALSP that offers a legal network gives asset managers the ability to bring on more freelance lawyers when their workload increases or scale back as necessary.

What is an alternative legal service provider?

An ALSP is an organization that offers a combination of purpose-built technology and services that enable it to perform a legal support function at a lower cost than traditional in-house legal departments or law firms.

ALSPs support legal matters with both advanced technology solutions and manpower typically made up of lawyers and other legal professionals with particular expertise. There are many ALSPs today handling all types of matters, from contract automation to ediscovery.

Types of ALSPs

- The largest accounting firms in the world: Ernst & Young, PricewaterhouseCoopers, Deloitte, and KPMG, known as the “big four.”

- Independent ALSPs, which are businesses entirely dedicated to providing legal tech and legal support services.

- Law firms’ subsidiary companies, called captive legal process outsourcing providers, which are similar to independent ALSPs.

- Staffing or temp agencies that connect businesses with lawyers and other legal professionals on a contract basis.

How are ALSPs different from law firms?

Unlike law firms, ALSPs don’t represent clients or participate in the representation of clients. They don’t provide legal advice. Instead, ALSPs help businesses and law firms with particular types of legal matters in a more cost-effective way than a traditional law firm could provide. While law firms focus on deep legal expertise and sound advice, ALSPs tend to focus on developing process expertise, legal software, or both to optimize repetitive tasks.

How to identify the right ALSP & prepare for a successful relationship

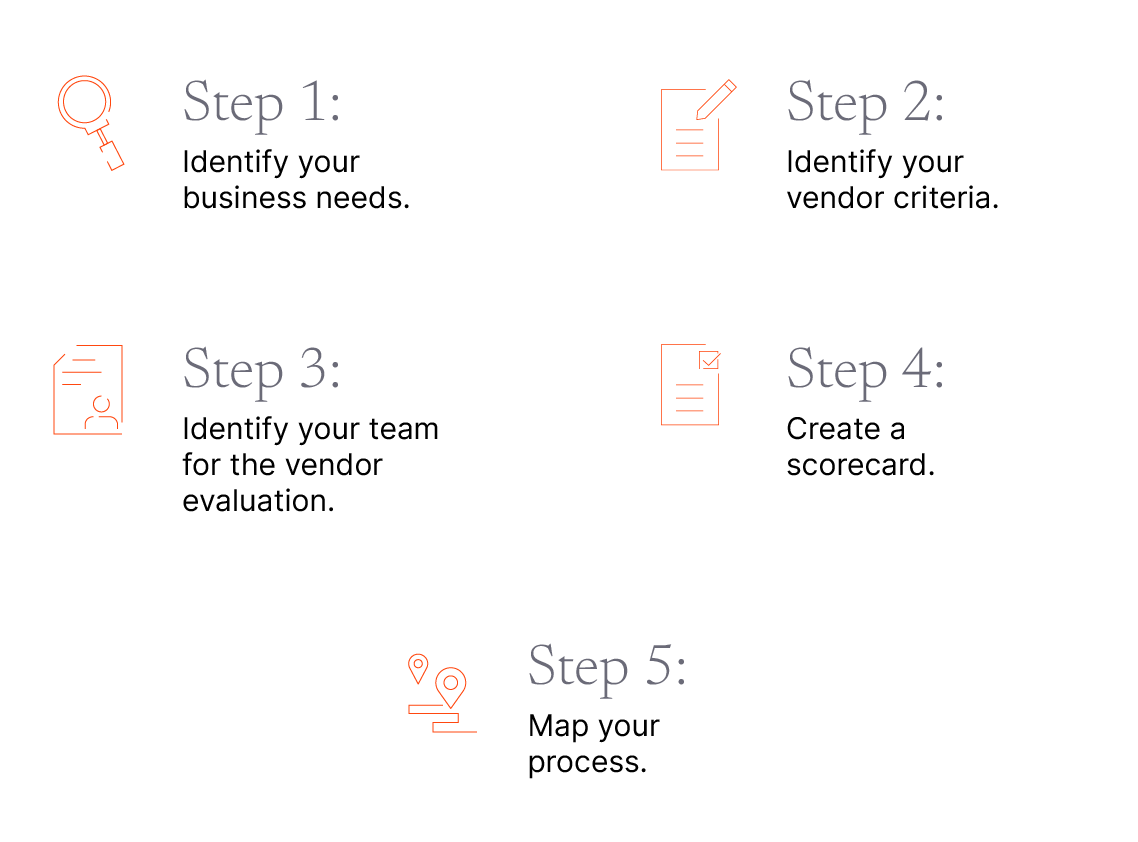

ALSPs are instrumental in helping asset managers digitally transform their legal and deal teams’ processes. However, a successful vendor implementation isn’t guaranteed. To achieve a long-lasting and productive relationship, asset managers should take the following steps to identify the right ALSP partner:

Assess internal needs

The process of identifying and selecting the right ALSP requires an acute awareness of the asset manager’s needs. Managers must first recognize an internal struggle or pain point and seek an ALSP that specifically addresses it. A common challenge for large asset managers is a high volume of NDAs. These agreements are an essential step in being able to evaluate target investments, yet delays in executing NDAs can cause a manager to lose out on a deal.

Build a search team & process

Asset managers find ALSPs in all sorts of ways, including through legal tech companies’ independent outreach. In this scenario, an internal champion might drive adoption. However, when a manager proactively looks for a solution, it should form a team and process for the vendor search.

Identify ALSPs with industry experience

Asset managers face legal processes and challenges that differ from other industries and even from other organizations within financial services. It’s necessary for managers to partner with ALSPs that are keenly aware of the manager’s unique needs and concerns, such as increasing regulatory oversight.

Identify ALSPs that can streamline onboarding

A common misconception is that the initial engagement of an ALSP always takes significant time and energy up front. It’s true the implementation process for legal services can be complex. However, an experienced ALSP should offer a customizable yet proven process to make for a smooth onboarding experience.

Evaluate the relationship after onboarding

A partnership with an ALSP can’t run on auto-pilot. During the first several months, regularly evaluate the services the ALSP completes. When evaluating the effectiveness of an engagement, asset managers must determine if the ALSP has solved the problem it set out to fix. If increasing process efficiencies was the goal, managers should verify that such processes have become more effective than when the manager handled them internally or outsourced to a traditional law firm.

Humanize the process

When implementing a legal tech solution, asset managers might overlook the human element. General counsels and deal professionals stand to achieve the greatest success through fostering strong relationships internally with key stakeholders and externally with the ALSP and ensuring open, collaborative communication.

The purpose of these steps is to avoid a failed legal tech adoption and build a long-term relationship with an ALSP. When an asset manager chooses the right partner, it’s more likely to optimize its legal processes, experience a return on its investment, improve employee morale, and support additional digital transformation efforts within the firm.