Cumbersome and mind-numbing as it may be, processing high-volume repetitive contracts (think non-disclosure agreements and service agreements) is a necessary part of nearly every business’s operations. In the face of high hourly rates for external law firms, though, many companies assume that they can keep costs low by handling these legal processes in-house. Often, though, businesses underestimate the true cost of insourcing.

The cost of insourcing vs. outsourcing

The cost of outsourcing is relatively straightforward: The customer and provider agree on a price for the external services delivered. There is relatively little mystery involved with that calculation. Conversely, the cost of insourcing, or keeping specific tasks in-house, tends to go untracked.

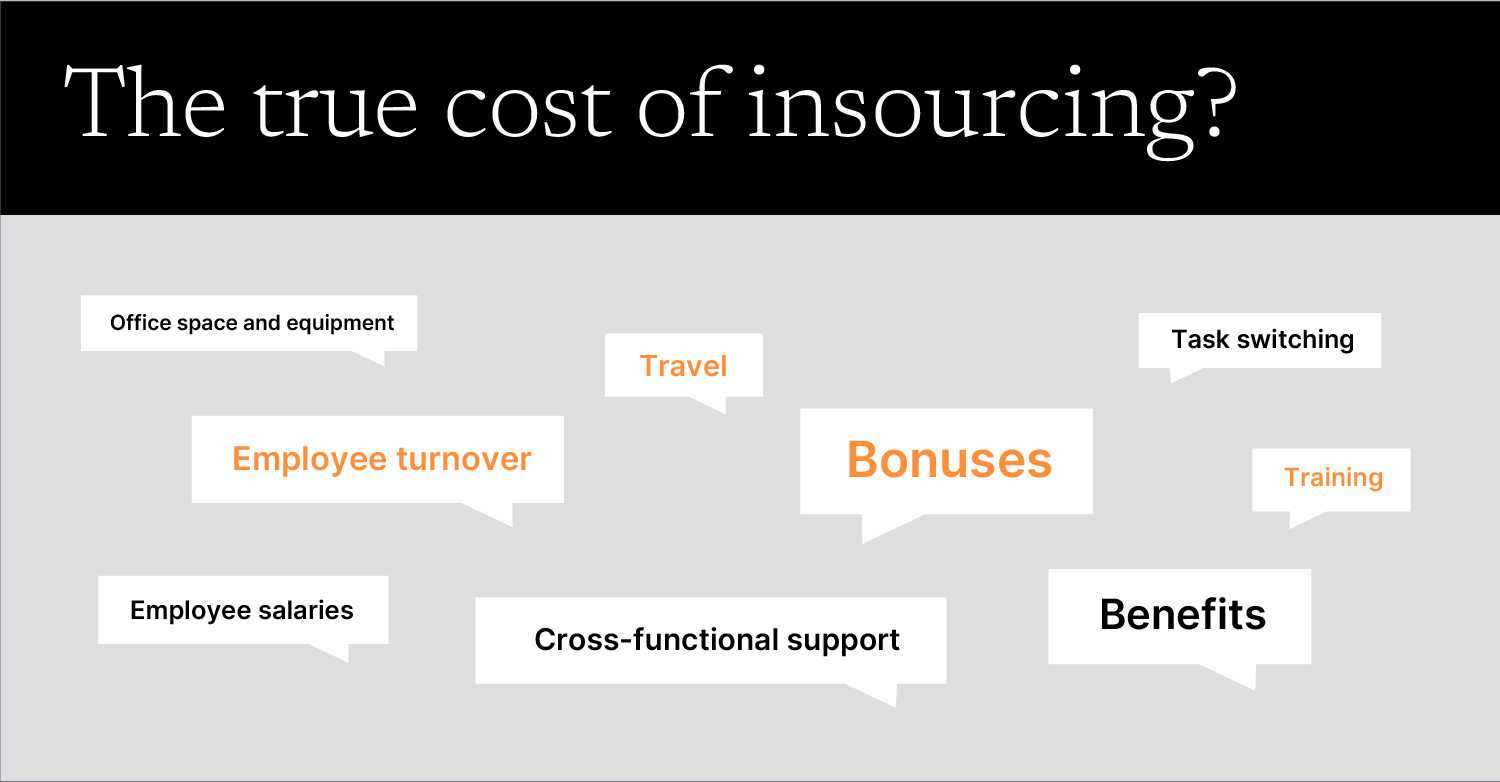

Businesses rarely account for insourcing costs such as IT, real estate, and travel, as well as intangibles like opportunity costs, task-switching, and employee turnover despite their huge impact on the bottom line. The likelihood of miscalculation is particularly high in the case of lower-value, repetitive activities, such as reviewing and managing high-volume contracts.

Insourcing high-volume, routine legal work is standard practice for many companies and is usually handled by in-house lawyers. The decision to keep this work in-house was made years ago when the only alternative was sending it to an expensive, traditional law firm. While insourcing may have been the most sensible choice at that time, new and innovative legal technology solutions have since expanded the list of options. Given the rise of these alternatives, companies must reassess the allocation of their resources by comparing these focused, cost-effective providers to the true cost of insourcing.

What is the true cost of insourcing?

It costs companies far more than they think to internally manage high-volume legal work like NDAs, vendor contracts, and engagement letters. For example, one of Ontra’s customers estimated that insourcing the company’s NDAs cost the company about two-thirds of a legal team member’s salary, about $133,000. We worked with our customer’s team to build on that calculation, pointing out less obvious costs.

The updated calculation treated employee salary as a baseline and then added the cost of bonuses, employment taxes, benefits, office space, travel, and back-office and management support. Next, we included the costs of turnover and task switching. Both of these inefficient practices contribute to high costs for low-impact work. We also included the value of keeping more complex legal work in-house, reducing the customer’s monthly bill from a law firm. The final figure showed the company’s cost to be more than $1.1 million for high-volume contracts, about 8.6 times the initial estimate.

While it may seem counterintuitive, insourcing may lead to higher expenses and lower efficiency when managing high-volume contracts. See how Ontra’s Contract Automation solution can streamline processes today.