Ontra continues to be a trusted leader in AI-powered solutions for private markets. Our suite of solutions helps firms drive efficiency, fuel growth, and outperform their peers. Discover how Ontra pushed the boundaries of AI in 2025 while providing secure, reliable solutions to many of the largest asset managers in the world.

Ontra enjoyed an explosive 2025, kicking off the year by earning the 2025 Great Place To Work Certification™. The prestigious recognition is based entirely on employee feedback, with 94% of respondents stating that Ontra is a great place to work, exceeding the 57% average for typical U.S.-based companies.²

To fuel our growth and accelerate product development, we closed a $70 million financing round with Silicon Valley Bank (SVB) in June 2025. We crossed over 400 employees, making significant investments in our R&D and Engineering teams.

Most importantly, we’ve continued working hand in hand with our customers to explore new features, launch new products and services, and ensure they benefit from the efficiencies that Ontra’s AI-powered solutions can deliver. We learned what was working for our customers and what they needed most at our November Customer Advisory Board in NYC. Senior leaders from some of the world’s top private markets firms provided honest feedback and valuable insights on where we should go next.

We ended the year on a high note, with over 1,000 private markets firms, including 9 of the 10 top PEI firms in the world, trusting and partnering with Ontra to accelerate their critical workflows.

A comprehensive AI platform for private markets

Last year, Ontra focused on expanding our AI-powered platform to solve more of our customers’ most challenging problems. “Our customers face an increasingly complex landscape where manual processes, point solutions, and horizontal software are holding them back,” said Troy Pospisil, Ontra Founder and CEO. We launched three new solutions, closed a financing round with SVB, and crossed over 2 million documents processed through our platform.

Negotiation solutions

Contract Automation

Contract Automation is an AI-powered, human-in-the-loop contract negotiation solution. With the help of a global Legal Network, we automate private markets firms’ most repetitive and high-volume agreements, from buy- and sell-side NDAs to vendor agreements and more.

Our global Legal Network comprises over 700 independent legal professionals — including former employees of AmLaw 100 firms — across 29 countries and 23 languages. The breadth and depth of network members’ experience enable us to support many of the world’s largest asset managers.

Accord

In early 2025, we launched Accord, an in-house contract negotiation software solution. Now, private market firms can use either or both products to negotiate, analyze, and manage contracts faster and at lower cost.

Compliance solutions

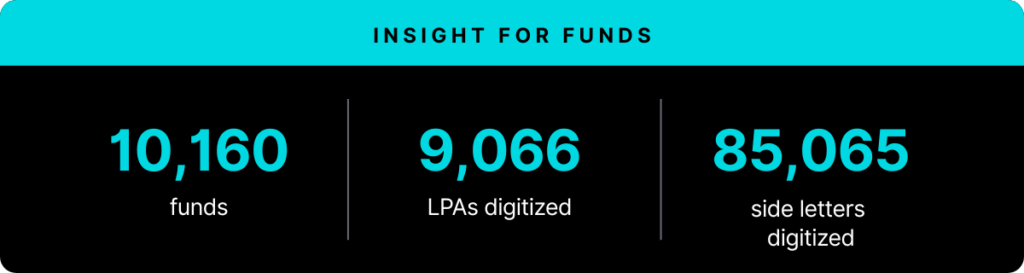

Insight for Funds

Insight for funds, launched in 2021, is the AI solution for obligation management. Contract digitization creates a searchable, digital compendium for LPAs, side letters, and MFN election forms. Customers can access their document repository, search their obligation data to answer questions or compare contract language, and manage compliance workflows with automatic reporting.

Customers can build multi-stakeholder task workflows to support compliance with critical event-based and recurring obligations. They can easily monitor and report on compliance with a few clicks, drastically reducing the stress of an audit or SEC exam.

Insight for Credit

In 2025, we further expanded our AI capabilities across document types. With Insight for Credit, our customers can now easily abstract, understand, and compare key terms and covenants across their credit agreements. They can track upcoming deliverables and meet commitments to lenders in one place.

Customers have instant access to agreement summaries and term comparisons, alongside restrictions and requirements previously buried across documents hundreds of pages long, enabling them to easily benchmark terms from past agreements during new negotiations and confidently track debt covenants.

Reverse KYC Services

We also launched a fully outsourced, end-to-end reverse KYC service for private markets firms. Our customers entrust their end-to-end KYC process to Ontra’s deeply experienced team, which handles counterparty correspondence from initiation to clearance. Our flexible team acts as an extension of the customer’s staff, operating from a pre-agreed playbook that standardizes responses, minimizes escalations, and accelerates clearance.

Read the full press release.

Coming soon: DDQ

In collaborating with our customers, we found that Due Diligence Questionnaires (DDQs) were an escalating pain point. The traditional, manual approach to DDQs is time-consuming, inefficient, and risky.

Ontra’s DDQ is an AI-powered solution that helps fund managers quickly answer, track, and respond to investor requests with confidence. It accelerates DDQ workflows, standardizes answers with AI-powered suggestions, and helps firms create a single, reliable source of truth.

Governance solutions

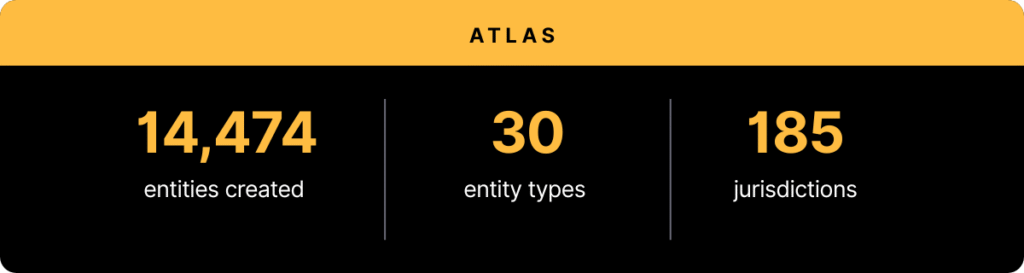

Atlas

We launched Atlas, our AI-powered, modernized entity management solution, in 2023. Since then, it has grown to become a key governance tool for leading private markets firms.

Top-of-the-line data security

Throughout Ontra’s expansion, our customers’ data privacy and security have remained top of mind. We are committed to maintaining zero-data-retention policies with our LLM providers, robust end-to-end encryption, and leading industry certifications. And the bottom line: We don’t use your data to train our models.

Throughout Ontra’s expansion, our customers’ data privacy and security have remained top of mind. We are committed to maintaining zero-data-retention policies with our LLM providers, robust end-to-end encryption, and leading industry certifications. And the bottom line: We don’t use your data to train our models.

Visit our Trust Center to learn more.

Giving back to the community

In 2021, we began donating $1 per contract processed through our Contract Automation solution. In 2023, we expanded the LAA program to donate $1 for every document processed via all of our solutions, and we moved beyond the U.S. to make donations in Europe and Asia-Pacific.

We are donating $439,665 based on 2025 documents processed, officially crossing over $1,366,264 in total donations!

Ready to partner with Ontra?

Whether you’re just learning about Ontra or are a customer interested in expanding into new solutions, reach out today.