The private markets landscape is evolving rapidly. With relentless regulatory shifts and rising investor expectations, firms face greater pressure to operate reliably, efficiently, and quickly. At Ontra, we’ve been listening closely to our customers to understand and respond to these challenges.

Today, we’re proud to announce Ontra’s next chapter: the expansion of our AI-powered platform for private markets with three new solutions, addressing even more critical negotiation, compliance, and governance workflows.

One platform. More solutions. Greater impact.

Historically, private market firms relied on ad hoc processes and inefficient, manual systems to manage their operations. Today, the landscape is even more complicated. Internal mandates to embrace automation and AI have spurred a rapid, reactionary wave of technology adoption, delivering isolated fixes, duplicating efforts, and leaving organizations unclear on who’s adopted what or why. Firms are left navigating a patchwork of point solutions and generic AI tools never designed for the unique demands of private markets, resulting in siloed operations and unreliable data that prevent firms from scaling with confidence and speed.

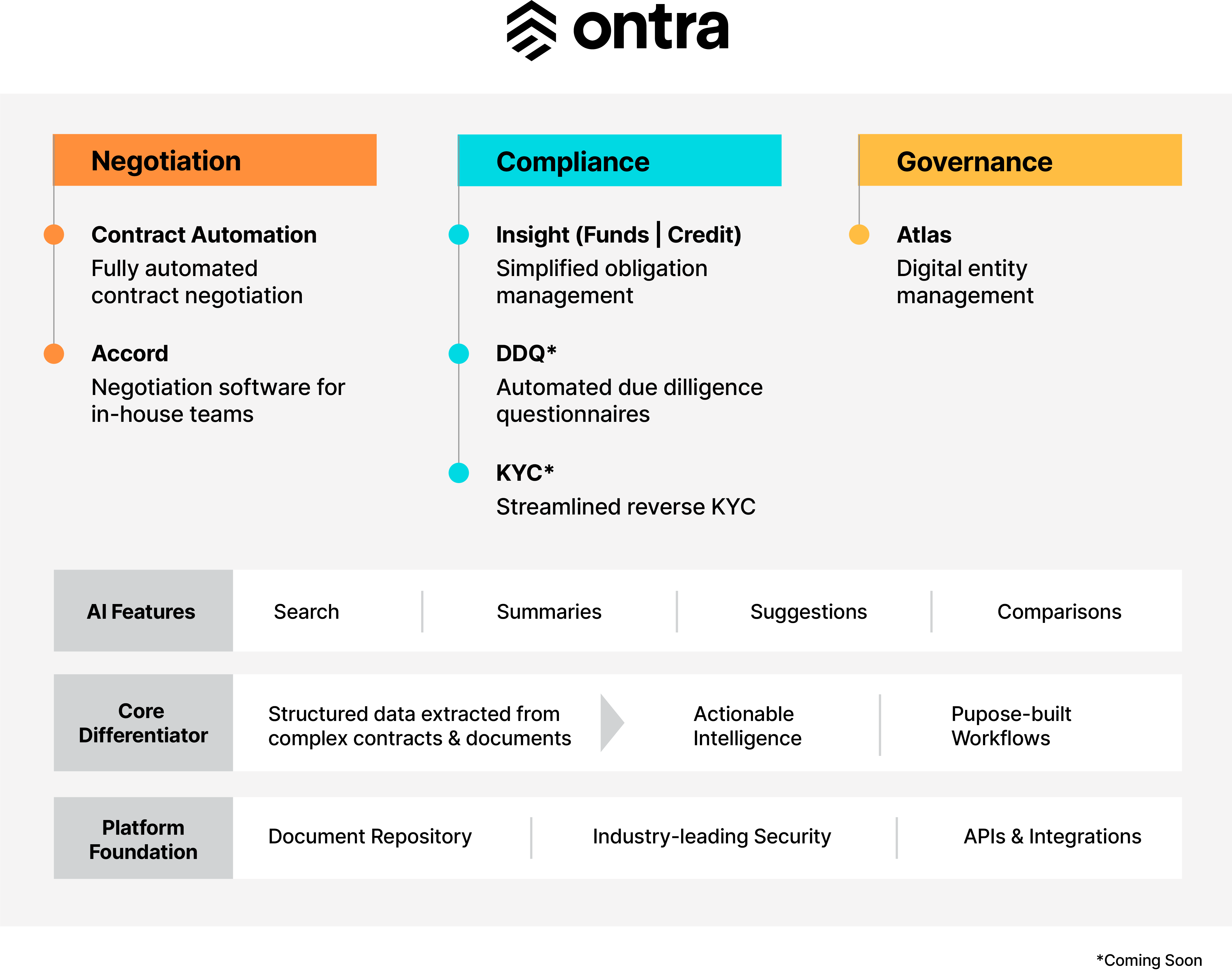

Ontra is redefining this landscape. Our platform delivers actionable intelligence and automates the most critical negotiation, compliance, and governance workflows across a broad suite of solutions.

Ontra’s suite of AI-powered solutions

Negotiation

Contract Automation finalizes NDAs, NRLs, joinders, and more with a global network of legal professionals for faster turnaround, fewer revisions, and greater consistency.

Accord centralizes contracts for in-house teams, helping standardize terms, automate redlines, and track progress so that every negotiation is run quickly and transparently.

Compliance

Insight for Funds creates a searchable digital compendium of fund obligations, making it easy to monitor deadlines, ensure compliance, uncover risks, and run MFN.

Insight for Credit turns credit agreements into a digital compendium of lender requirements, so it’s simple to track covenants and deadlines to maintain compliance.

DDQ* delivers faster, more consistent responses to investor questionnaires with AI-powered suggestions from a proprietary knowledge base.

KYC* streamlines reverse KYC with the support of an experienced analyst team for faster clearance and greater consistency.

Governance

Atlas centralizes entity and ownership data in a single source of truth for instant access, secure third-party sharing, and automated structure chart generation. Track recurring governance tasks from one place to ensure accuracy and audit readiness.

*Coming Soon in 2025

What makes Ontra different?

Ontra was purpose-built for private markets, by private markets experts. Unlike generic or industry-agnostic tools, each capability directly addresses the specialized workflows, unique risk profiles, and evolving regulatory needs of private funds.

- Purpose-built AI: Guided by deep domain expertise and proprietary insights from over a million contracts, Ontra’s AI precisely extracts and organizes critical information from even the most complex documents.

- Actionable intelligence: With data now structured and organized, unlock new insights. Instantly summarize trends, compare documents, and surface answers to nuanced questions unique to private markets to drive confident, data-driven decisions.

- Automated workflows: Ontra data and intelligence fuel negotiation, compliance, and governance workflows so teams can move faster and focus on growth.

With Ontra, investment firms can move beyond static documents and operate with the efficiency, reliability, and agility needed to lead in today’s private markets.

Benefits of Ontra’s platform

Drive operational excellence

Eliminate manual bottlenecks and administrative drag. Ontra automates everything from contract redlining to compendium creation to structure charts, letting your teams refocus resources on strategic work, not busywork.

Ensure compliance and manage risk

The stakes are high: delays, missed covenants, and changing regulatory demands can derail operations and threaten firm reputations. Ontra’s platform centralizes precedent, obligations, tasks, entity data, and more, turning reporting and compliance from a reactive approach to a reliable, consistent process despite industry uncertainty.

Act fast in a competitive market

Time kills opportunities. Ontra’s AI-powered solutions suite empowers teams to finalize agreements, respond to diligence requests, meet obligations, and seize opportunities faster than competitors can.

Schedule a demo today

As the industry’s leading platform with a solution suite specifically built for these challenges, Ontra’s mission is to help our customers not only keep up with change but lead it.

Ready to accelerate workflows and unlock efficiency? Reach out today to schedule a demo.