Benefits

Deliver the Institutional-Grade Fundraising Experience Your Investors Expect

Simplify Investor Onboarding

Automate subscription documents to seamlessly onboard and delight investors.

Understand Investor Status

Get real-time visibility into investor progress from opportunity to close.

Reduce Expenses

Process subscription documents with fewer resources and less external legal spend.

Expedite Your Close

Reduce the administrative burden by clearing investors to close in days, not weeks.

Features

Leverage Innovative Technology to Transform the Way You Fundraise

FundFormer streamlines the fundraising process for managers, investors, and third parties by providing a seamless digital subscription experience. It’s the fundraising platform that exceeds investor expectations.

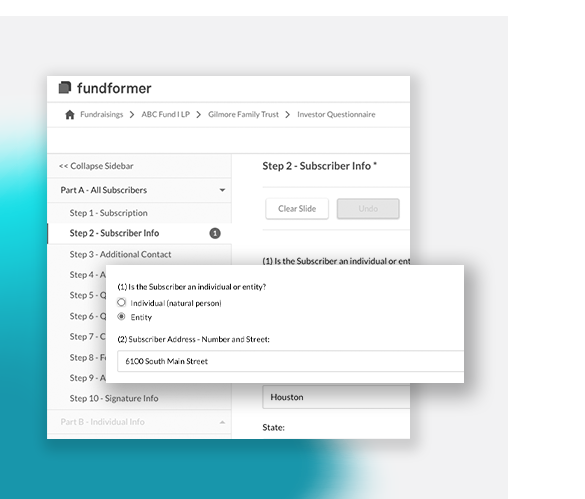

Digital Documents

Convert PDF subscription documents to SmartForms with conditional logic to save investors time.

Require submission of critical information to guarantee data completeness and reduce time spent on follow-ups.

Allow third parties to comment and provide feedback directly in the form, centralizing communications.

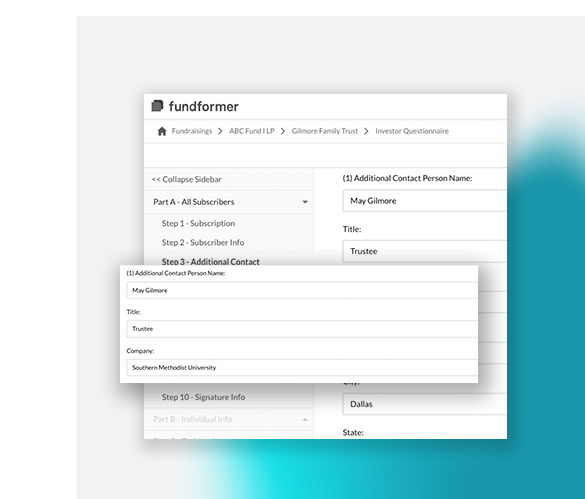

Investor Profiles

Auto-populate forms using pre-existing profiles to create a seamless investor experience.

Ensure the consistency of investor information across all documents and funds.

Request a demo to learn more.

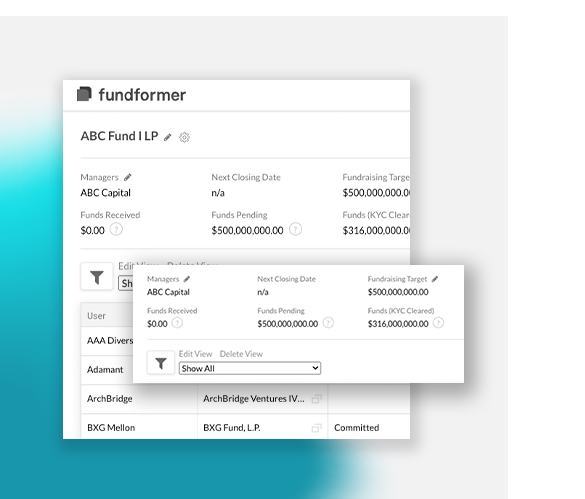

Fundraising Dashboard

Leverage a consolidated view of your pipeline to understand progress toward your fundraising goal.

Automatically alert fund administrators, legal counsel, and other third parties of required next steps.

Enable distributed fundraising teams to collaborate in real time.

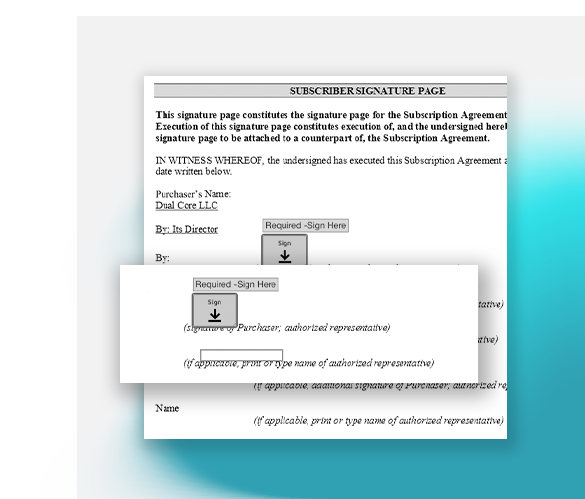

eSignature

Sign documents from anywhere and any device via DocuSign integration.

Prompt signatories to take immediate action through automated reminders.

Institutional-Grade Security & Compliance

Collect all required investor documents to comply with tax, anti-money laundering, and know your customer requirements.

Maintain data integrity across software systems by easily exporting critical investor documents and data.

How FundFormer Works

Digitize Documents

Subscription documents are digitized using conditional logic to guide investors through relevant questions.

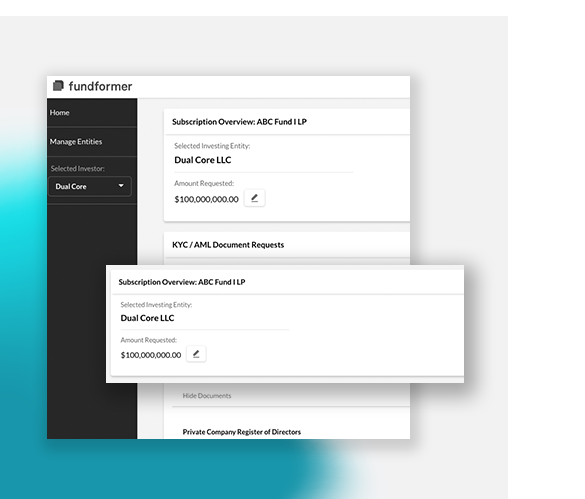

Complete & Review Subscriptions

Investors complete relevant subscription questions and provide required AML/KYC documentation in a white-labeled portal. Repeat investors can use saved investor profiles to confirm their information in a few clicks. Third parties review and provide comments.

Track Pipeline & Sign

Track investors’ status in real time as they progress through the fundraising process. Counterparties sign completed forms via DocuSign. Easily export investor documents and data.

Examples of Documents Serviced:

Subscription Documents

Side Letters

Limited Partnership Agreements

KYC/AML Documents

Testimonial

Leading Firms Leverage FundFormer to Transform the Way They Fundraise

Firms using outdated fundraising methods lack real-time visibility into their pipeline and get bogged down by manual work, slowing their time to close and increasing the risk of error. FundFormer eliminates inefficiencies and empowers asset managers to simplify and expedite the fundraising process from opportunity to close.

“In addition to trimming at least two weeks off our investor onboarding time, there’s a certain sense of security knowing that the FundFormer team is led by attorneys with deep legal backgrounds. This is extremely important to us because they’re taking our PPMs and our subscription documents and reconfiguring them from a legal framework into a usable document that’s now online and clickable.”

Bob Griffin

Principal & Director of Business Development, WhiteTower Capital Management

Principal & Director of Business Development, WhiteTower Capital Management