Managing contract compliance in private markets feels like being an air traffic controller on a busy holiday weekend. The sheer volume and complexity of legal agreements — from side letters to credit facilities — create a copious number of obligations that can expose private markets firms to significant risk, like a radar full of overlapping flights.

Manually tracking the commitments arising from these agreements is not only inefficient, but it also increases the risk of costly errors, missed deadlines, and damaged relationships. To better manage contract compliance, stop relying on outdated methods and embrace a smarter approach to contractual compliance with purpose-built AI solutions.

The complexity of private markets compliance

Private fund managers execute a significant volume of legal agreements: NDAs, vendor contracts, LPAs, side letters, and credit facilities, to name a few. These contracts create a web of obligations that impact fundraising and deal opportunities, fee and expense calculations, notice requirements, and even regulatory compliance.

Side letter compliance

In recent years, private funds have seen side letters become more common, longer, and more complex. According to Ontra’s proprietary data, the average number of funds managed by a firm has more than doubled since 2016. And, in the past five years, the average number of side letter pages has jumped 25%, while the average word count has increased by 28%.

More funds, each with longer, more complex side letters, create a massive administrative and operations burden. When firms rely on manual processes or off-the-shelf solutions to manage these contract commitments, they incur unnecessary risk and expense.

Legal, compliance, and investor relations teams often depend on spreadsheets or a mix of fragmented software solutions with limited visibility. Search functions — sometimes as basic as Ctrl+F — rarely provide full and accurate answers.

MFN compliance

Many side letters include an MFN provision, increasing firms’ workload. Firms typically rely on outside counsel to run MFN elections, and most law firms lack purpose-built software to support this process. Instead, they continue to rely on manual tasks and decentralized sources of information, limiting the GP’s visibility into the process and racking up costs. While most fund managers wish for their MFN elections to take fewer than 90 days after the fund’s final close, inefficient processes can push that timeline upwards of 9-12 months.

Credit agreement compliance

Along with the growing number of funds comes a greater number of credit agreements, each with contracts hundreds of pages long and full of affirmative covenants and restrictions. Private market firms must deliver on their commitments to lenders and comply with all covenants across their credit agreements.

Many firms still rely on manual obligation management processes for credit facilities, which creates a significant operational burden for finance, legal, and compliance teams. Failure to proactively comply with covenants can result in breaches of contract, loss of critical funding, and significant reputational damage.

Top 5 contract compliance challenges

1. Overcoming manual and inefficient workflows

Many private markets firms continue to rely on manual methods like spreadsheets, emails, and shared drives for managing investor, lender, and regulatory compliance obligations. These time-consuming, resource-intensive, and error-prone processes are no longer sustainable given the increasing volume and complexity of agreements.

Decentralized oversight creates data gaps and increases the risk of missed obligations and disputes. Additionally, it prevents teams from having a holistic view of their commitments, which is essential for managing risk and ensuring compliance across the entire firm.

2. Ensuring proactive compliance with covenants

Managing affirmative and financial covenants is a significant operational burden for fund managers and their portfolio companies. Manual processes for tracking these obligations across numerous credit facilities create a high risk of non-compliance.

Failing to proactively meet these commitments can lead to severe consequences, including loan defaults and reputational damage. This challenge is felt by numerous teams, but finance, compliance, and legal teams are primarily responsible for ensuring these critical obligations are met to maintain investor trust and safeguard the firm’s financial stability.

3. Managing negative covenants and business decisions

A lack of a single source of truth for credit agreement terms makes it difficult for private fund managers to quickly determine whether a specific action is permissible. The inability to easily access, find, and understand the terms they’ve agreed to in various credit facilities can lead to delays in critical business decisions.

Firms often have to spend time and money on external legal counsel to interpret terms that should be readily available internally, which exposes the firm to unnecessary risk and operational friction.

4. Understanding historical and current terms

Private fund managers struggle with limited visibility into past LPAs, side letters, and credit agreements. Vital information is often siloed in disparate documents and systems, making it difficult for teams, particularly deal and finance teams, to access and compare historical terms and promote standardization in new agreements.

The lack of a unified, easily searchable repository of agreements hinders teams’ ability to strategically negotiate new side letters and credit facilities, which can lead to inconsistencies that negatively impact compliance processes.

5. Navigating complex MFN election and disclosure processes

For fund managers, running efficient MFN elections is a major challenge even when relying on top BigLaw firms. The manual nature of this workflow is administratively burdensome, time-intensive, and prone to human error. Teams must meticulously generate, distribute, review, and track MFN forms and disclosures for a growing number of LPs.

MFN elections are further complicated by the need to adhere to strict reporting deadlines and manage a wide array of side letter obligations. Inefficient MFN processes can jeopardize LP relationships, expose the firm to risk, and prevent timely compliance with updated obligations.

Consequences of non-compliance

Failing to meet a side letter obligation or credit agreement commitment can have significant consequences:

- Risk of loan default and loss of critical funding: Failure to comply with credit agreement covenants, especially financial ones, can trigger a breach of contract, leading to a loan default and the potential loss of a critical funding source for the firm.

- Legal and financial penalties: Non-compliance can result in litigation, damages, regulatory actions, and fines.

- Significant reputational damage: Missing key obligations can harm a firm’s reputation with lenders and investors, eroding trust and potentially jeopardizing future fundraising efforts and business relationships.

- Jeopardized relationships with LPs: In the context of MFN elections, failure to comply with updated obligations can disrupt the GP-LP relationship and threaten future investments.

Contract compliance best practices

Shifting to an efficient and proactive contact compliance program requires several changes, from implementing industry-specific AI to establishing ownership and automating tasks and reminders whenever possible.

Centralize agreements with a purpose-built solution

Instead of using scattered spreadsheets and PDFs, adopt an AI-powered compliance solution built for private markets. With a purpose-built solution, you can digitize the firm’s agreements to create a central, digital repository for all credit agreements and fund documents. This single source of truth allows teams to easily search, understand, and compare key terms, transforming complex legal documents into structured, actionable data and providing the historical context needed to negotiate more consistent terms.

Standardize workflows with clear ownership

Manual processes are inefficient and risky. To mitigate this, streamline contract management processes from understanding key terms to fulfilling obligations. Create clear, standardized procedures and assign ownership for specific tasks. By outlining who is responsible for tracking and delivering on commitments, firms can avoid siloed oversight, improve accountability, and ensure compliance.

Leverage AI to automate compliance and reduce risk

Move beyond reactive compliance by using AI to automate key tasks. Leverage AI abstraction to quickly identify and categorize covenants and other obligations within agreements. A purpose-built software solution can transform these complex clauses into actionable data, providing a foundation for automated task management, enabling firms to proactively track deliverables and manage risk.

Conduct regular audits for continuous compliance

A strong compliance program requires continuous monitoring. Implement a process for regularly performing contract compliance audits to review obligations and adherence to commitments across all active agreements. By leveraging a digital compendium, teams can easily export the necessary documents and data to conduct these reviews, ensuring they are always audit-ready. This practice reinforces a culture of accountability and diligence.

Contract compliance software from Ontra

Insight by Ontra is an AI-powered obligation management solution that provides firms with actionable intelligence from the data previously locked in their documents. Through Insight, firms can efficiently digitize, extract, and categorize their commitments across LPAs, side letters, and credit facilities.

Insight for Funds

Insight for Funds helps firms fulfill obligations to investors. Its features include:

- AI-powered contract digitization to abstract and categorize clauses from fund documents

- Digital compendium for a central, searchable repository of key provisions

- AI Search for quick, actionable answers based on the full scope of agreements

- Tasks to track and manage key commitments to investors

This solution also helps with obligation compliance and managing digital MFN elections. By automating compliance workflows, Insight helps firms mitigate risk, increase transparency, and reduce expenses.

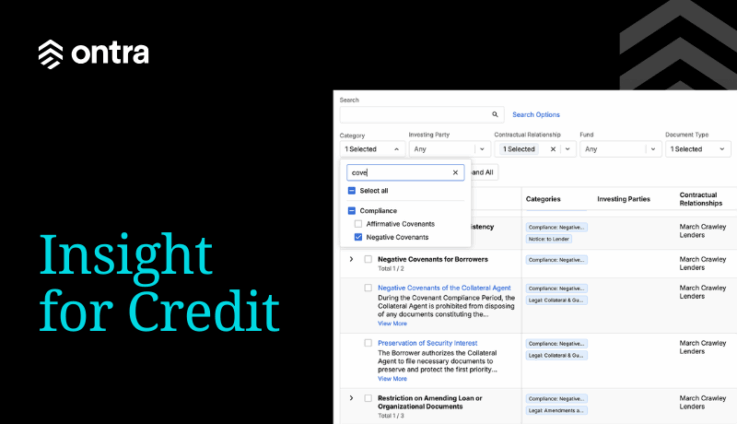

Insight for Credit

Insight for Credit helps firms manage their commitments to lenders. Its features include:

- AI-powered contract digitization to abstract covenants in credit facilities

- Digital Compendium for storing credit agreement obligations

- Term Comparisons to benchmark against past agreements

- Tasks to track and manage upcoming deliverables

This solution helps firms save time, stay competitive, manage risk, and strengthen compliance by enabling them to proactively monitor debt covenants.

Get started with Insight today

Ready to let go of time-consuming, manual contract compliance processes? Spend less time searching through spreadsheets and PDFs and more time on what matters most. Schedule a demo today: