Private fund advisers are always anticipating their next SEC examination. The SEC’s Division of Examinations (the “Division”) oversees the SEC’s National Exam Program with the goals of improving compliance, preventing fraud, monitoring risk, and informing policy. Each year, the Division publishes its exam priorities to prepare advisers, but the specific application of most rules is open to interpretation. As a result, there’s always a level of uncertainty in designing and implementing a compliance program.

As much preparation as CCOs and general GCs put into SEC exam prep, an exam and request for information are always stressful. The Division demands real-time data, and even the most prepared firms have a lot of work to do to deliver information quickly.

Dive into the SEC exam process and how the top advisers to private funds are preparing with AI-powered tech solutions.

What is the purpose of an SEC exam?

The Division conducts exams to assess whether your firm is:

- Conducting business in accordance with applicable federal securities laws and regulations.

- Adhering to the disclosures it made to clients, customers, the general public, and the SEC.

- Implementing and enforcing compliance policies and procedures that are reasonably designed to ensure compliance with relevant legal requirements.

Reasons why the SEC might choose your firm

The Division’s September 2023 risk alert offered additional guidance on the SEC exam process. The Division’s selection process is not random. It relies on a dynamic risk-based approach to select a small group of target firms out of 15,000+ registered advisers. The Division noted it takes a dynamic approach, which means its methodology changes based on current industry practices, market conditions, and investor preferences.

The Division considers a wide breadth of information, including a firm’s risk characteristics; tips, complaints, or referrals; and criteria relevant to focus areas described in the Division’s annual priorities.

The Division may also consider:

- Prior exam observations and conduct.

- Supervisory concerns, such as the disciplinary histories of associated individuals or affiliates.

- Business activities of a firm or its personnel that may create conflicts of interest.

- The length of time since a firm’s registration or last examination.

- Material changes in a firm’s leadership or other personnel.

- Indications that an adviser might be vulnerable to financial or market stresses.

- Reporting by news and media that may involve or impact a firm.

- Data provided by certain third-party data services.

- The disclosure history of a firm.

- Whether a firm has access to client and investor assets and/or presents certain gatekeeper or service provider compliance risks.

Has the new administration altered SEC exams?

In April 2025, Paul Atkins was sworn in as the chairman of the SEC. The industry expects SEC enforcement under Atkins to focus on traditional issues impacting investors and emerging technologies, according to White & Case LLP.

Much has already happened at the SEC since Mark Uyeda was appointed acting chairman in January. Uyeda has overseen changes to the Enforcement division and a reduction in the SEC staff, including:

- The Enforcement Division’s regional directors have been reassigned to other senior roles, including Deputy Director positions.

- A majority of SEC Commissioners must now approve formal orders of investigation.

- The SEC’s specialized crypto enforcement unit has been reduced, restructured, and renamed the Cyber and Emerging Technologies Unit.

- The Crypto Task Force continues to meet with industry players and develop guidance on securities to reduce market ambiguity and uncertainty.

Exams have not fundamentally changed. The industry expects enforcement on advisers to private funds to pull back and focus on traditional issues, such as insider trading, conflicts of interest, and disclosure fraud. Atkins has also spoken about concerns regarding emerging technologies, and the SEC will continue to investigate “AI washing” and fraud related to AI capabilities. Under Atkins, fund managers can expect the SEC not to pursue creative and novel legal theories, White & Case suggested.

How leading private funds prepare for their SEC examinations

Leading investment advisers find the best way to be ready for an SEC exam at any time is to build and enforce a proactive compliance program with the help of advanced legal technology.

Enforce proactive compliance

Many firms have old-school compliance programs comprised of spreadsheet-based compendia, decentralized document storage, manual tasks, and heavy (expensive) reliance on outside counsel. Answering questions, finding and producing emails, and reviewing expenses all take a significant amount of time, and worrying over non-compliance can keep GCs and CCOs up at night.

The SEC isn’t interested in seeing these types of programs anymore. The Director of the SEC’s Enforcement Division, Gurbir S. Grewal, went so far as to speak about his expectations regarding proactive compliance at the New York City Bar Association’s Compliance Institute 2023. He expects advisers to consider three factors: education, engagement, and execution.

CCOs must educate themselves and the firm’s employees on relevant laws and regulations, as well as any external developments relevant to the business. They need to fully engage with stakeholders across the organization and understand the various business lines in order to design appropriate compliance policies.

During the Stout Summit: Investment Funds and Alternative Assets 2023, Carmen Lawrence, Partner at King & Spalding, noted that smaller firms may begin with “off-the-shelf policies and procedures,” but over time, those should evolve to customized policies and procedures relevant to the firm’s needs.*

Finally, the SEC expects CCOs to fully execute their compliance policies and procedures and monitor the firm’s performance through periodic testing and annual reviews. Far too many advisers have missed a step by not adequately enforcing the firm’s compliance policies.

Adopt purpose-built technology

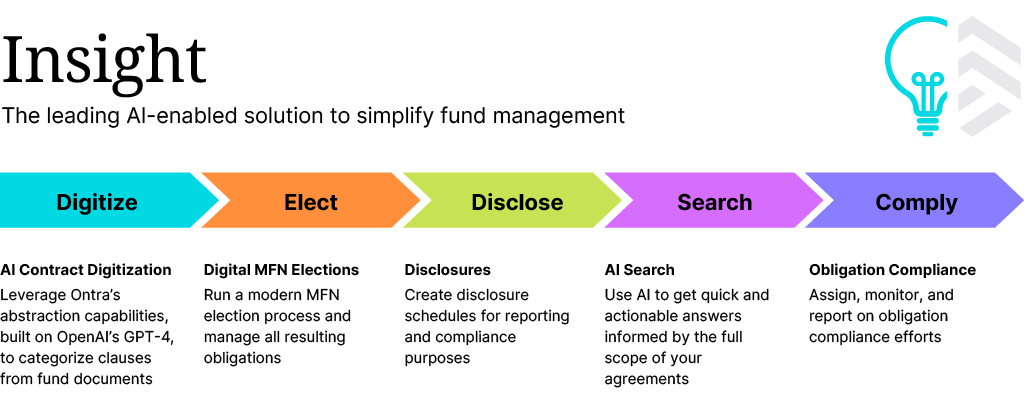

Technology solutions like Ontra’s private markets technology platform enable proactive compliance programs. Insight from Ontra providers centralized document storage, digital compendia, AI-powered search, multi-stakeholder task workflows, digital Most Favored Nations elections, and other features to accelerate compliance processes daily.

A key functionality of Insight is the ability to quickly respond to the SEC to demonstrate your firm’s compliance with side letter provisions. With a few clicks, you can download an overview of your fund documents and side letters, produce the underlying documents themselves, and generate a list of the general partners’ specific obligations to investors. These exports enable you to swiftly supply the Division staff with fund and side letter compliance information and start your exam on the right foot.

Leverage mock exams

A proactive compliance program involves periodic internal reviews of compliance procedures and their effectiveness. These reviews and tests also offer an opportunity to update policies and procedures based on recent changes, such as new regulations, market conditions, or investor obligations. Additionally, working with a third party to go through a mock exam is an excellent way to test your firm’s procedures, including document collection and delivery.

2025 SEC examination priorities for advisers to private funds

The SEC’s FY 2025 Examination Priorities report stated it will prioritize reviewing:

- Whether disclosures are consistent with actual practices; if an adviser met its fiduciary obligations in times of market volatility; and whether a private fund is exposed to interest rate fluctuations. The Division may focus on advisers to private funds experiencing poor performance and significant withdrawals and/or holding more leverage or difficult-to-value assets.

- The accuracy of calculations and allocations of fund- and investment-level private fund fees and expenses.

Disclosure of conflicts of interest and risks, and adequacy of policies and procedures. - Whether advisers have established adequate policies and procedures and whether their actual practices conform to recently adopted SEC rules, including amendments to Form PF and the Marketing Rule.

Additional SEC examination priorities include reviewing emerging financial technologies and cybersecurity. The Division may examine how an adviser employs particular tools or methods, including whether it has controls in place to ensure proper disclosure to investors.

With respect to AI, the Division will review an adviser’s representations regarding their AI use and capabilities. It’ll also determine whether the adviser has adequate policies and procedures to monitor their use of AI.

How does the Division conduct SEC exams?

Step 1 – Scope the examination

The Division will determine the scope of the exam after it selects an adviser. This is another area where it takes a risk-based approach and adapts the exam to the particular firm. In some cases, the Division will examine a firm’s operations broadly, while at other times, it will focus on a specific topic, issue, or risk.

Step 2 – Make contact with the adviser

The Division can pursue announced or unannounced exams. For an announced exam, the Division typically contacts the firm’s CCO or another regulatory professional to inform them of an upcoming on-site or remote exam. Though it’s rare, the Division can arrive on-site unannounced.

Step 3 – Request documents

The Division typically sends a request for documents through a secure email. During an unannounced visit, the Division will provide a request for information and may also perform an initial interview.

The Division gives the adviser a reasonable amount of time to provide the requested information. For an announced on-site visit, the Division will require the information prior to the visit. For remote exams, the adviser typically has one to two weeks to provide the requested information.

At the onset of the exam, the Division will also supply the firm with a copy of Form 1661, which describes the possible uses of the information and documents the firm provides to the Division’s staff.

Step 4 – Schedule meetings with key personnel

The Division typically asks to meet with certain employees, such as the CEO, CCO, CFO, and operations lead, to go over the firm’s operations and the information provided in the documentation. These meetings can be in-person or via telephone or videoconference. During in-person meetings over a few days, the Division staff might ask for a tour of the firm’s offices.

Step 5 – May make supplemental requests for information

Following the initial delivery of documents and meetings, the Division staff might request additional information from the adviser. It might also ask third-party service providers, agents, or custodians for relevant documents or information.

Step 6 – Conduct a preliminary exit conference

During an exit conference, the Division staff can provide a status update on the exam or any outstanding requests for information. It might also discuss issues identified at that point in the exam process, giving the adviser the opportunity to discuss the issues and provide additional relevant information, including remedial actions, as necessary.

Step 7 – Provide written notice of SEC exam completion

The Division will send the adviser written notice that it has finished the exam, either with or without findings, or that it requires the adviser to take corrective action. Typically, the Division sends a deficiency letter, which the adviser must respond to within 30 days. A vast majority of firms receive a deficiency letter following an exam.

Step 8 – May refer the case to an enforcement entity

The Division can refer serious issues to the SEC’s Division of Enforcement or another agency, such as a state or criminal authority.

Common SEC document requests

You can expect the Division to request documents related to:

- General information regarding your firm’s business and investment activities, such as organizational information, business and operations information, disclosures and filings, and legal and disciplinary information.

- Information regarding your firm’s compliance program, risk management, and internal controls.

The written policies and procedures your firm has adopted and implemented to address identified risks. - Information to facilitate testing with respect to advisory trading activities, such as information about the firm’s current and past advisory clients and accounts, portfolio management, brokerage and trading, and conflicts of interest and insider trading policies.

- Information to support the Division’s compliance testing, such as the firm’s financial records, custodial information, and marketing and advertising materials.

For more information, see the Typical Initial Information Examiners Request of Investment Advisers attached to the risk alert.

SEC enforcement actions & penalties

Given the potential outcomes, SEC exams are stressful events. Most exams result in deficiency letters requiring a response within 30 days and corrective action within 180 days. In some cases, the Division refers issues to the SEC’s Division of Enforcement, which investigates alleged violations of federal securities laws and oversees civil actions in administrative proceedings and federal courts.

The SEC filed 583 enforcement actions in FY 2024, including 431 standalone actions. The largest primary classification for enforcement actions was investment advisers/investment companies, though the largest number of parties involved in actions were classified under securities offerings.

While FY 2024 saw fewer enforcement actions than the previous four years, FY 2025 started off strong. The SEC filed 200 enforcement actions in the first quarter of FY 2025 — October through December 2024. It then filed more than 40 enforcement actions between January 1 and January 17, 2025.

Get ready for your next SEC exam with Insight

Insight is an AI-powered platform for the full private fund lifecycle intended to help your firm modernize and simplify fundraising and compliance processes. With Insight, you can be confident in your ability to quickly cooperate with the SEC and provide documentation supporting side letter compliance.

Schedule an Insight demo today.

*The organizations referenced in this article have no affiliation with Ontra, and neither Ontra nor such organizations promote or endorse the other’s products or services.